| A Major Reversal in China's Currency | | By Dr. Steve Sjuggerud | | Tuesday, August 8, 2017 |

| "How can you think about investing in China, Steve? There's no way you'll make money after it's done devaluing its currency!"

The idea of investing in China has become more mainstream in recent months. But there are still plenty of "bogeymen" surrounding the idea of investing in China...

For instance, ghost cities, debt bubbles, a powerful communist government, and the idea of massive currency devaluation, to name a few.

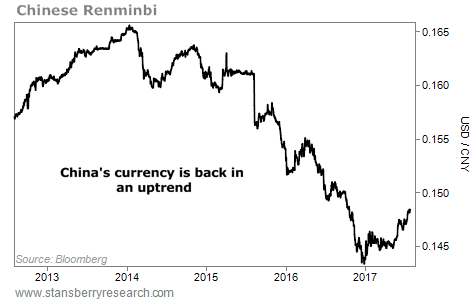

Currency depreciation has been a popular bogeyman in recent years... But things have shifted in 2017.

China's currency has begun a new uptrend this year. This is a powerful shift. And it could help power Chinese stocks even higher in the coming years.

Let me explain...

----------Recommended Link---------

---------------------------------

Folks have been worried about China's currency. And up until recently, it was for good reason.

From 2005 through 2013, China had a quasi-fixed currency value versus the U.S. dollar. The Chinese government allowed the renminbi to trade in a tight range versus the dollar with slow appreciation.

This meant a remarkably steady rise in the value of the renminbi. The table below shows the annual returns from 2005 to 2013. Take a look...

| Year | Renminbi Return | | 2005 | 2.5% | | 2006 | 3.3% | | 2007 | 7.0% | | 2008 | 7.0% | | 2009 | -0.1% | | 2010 | 3.4% | | 2011 | 4.8% | | 2012 | 1.1% | | 2013 | 2.9% |

China's currency spent a decade moving steadily higher. Investors got used to it. They weren't prepared for anything else. So they were shocked in 2015...

You see, in 2014, China changed the way the renminbi traded. It allowed the currency to "float" more than ever before. And the immediate rise stopped.

The renminbi fell by 2.4% in 2014 – its first annual loss since 2009, and only the second annual loss over the prior decade.

Then in August 2015, China devalued the renminbi by about 3% over a few days. That was a big move for a major currency... And it was followed by a handful of other small devaluations, and finally, an even freer floating system.

But investors didn't realize that this was a good thing.

Sure, investors became fearful that the Chinese government would further devalue its currency.

But it allowed China's stock market to open further. It generally opened up the Chinese economy. And if it never happened, we wouldn't have the opportunity we have in China today.

As longtime DailyWealth readers know, I've personally visited China twice in the past two years. And all the folks I've met expected the currency decline to continue. Everyone thinks it's an obvious outcome.

The blanket assumption is a steady 3%-4% decline, year after year. But take a close look and you'll see that 2017 is bucking that trend...

What's that, my friend? To me, it looks like a confirmed uptrend in China's currency.

It hasn't been a major news story. The financial news isn't talking about it. But the three-year downtrend in the renminbi appears to be over. The currency is up 3.5% so far this year, with no signs of slowing down.

I've been bullish on Chinese stocks for years. And that has been the right call, especially in 2017.

China's currency rising again creates a tailwind for China's stock market. This is only part of the reason I'm bullish on China. But this major reversal means the bogeyman isn't one to worry about.

China's currency is secretly in an uptrend. And that's another fantastic reason to own Chinese stocks now.

Good investing,

Steve |

Further Reading:

Investors have a big opportunity in Chinese stocks today. Last month, Kim Iskyan shared three industries set to boom over the coming years as China's middle class grows. "Just like the consumers in the U.S. did during its boom, China's middle class is set to spend its money on three specific industries." Get the full story here. But as Brett Eversole recently explained, China isn't a "buy anything" market. "While the overall opportunity is fantastic, a certain group of Chinese stocks is hitting multiyear lows," he writes. "And it's a group you want to avoid right now." Read more here: One Spot to Avoid in China's Stock Market Boom. |

|

A WINNER IN CONVENIENCE

Today, we look at a company benefiting from the smartphone revolution... Over the last six years, the number of smartphone users in the U.S. has exploded, more than doubling from around 93 million in 2011 to around 224 million today. That has fueled the growth in "on demand" services. Now, with the touch of a button, you can get a ride with car-sharing platform Uber, make dinner reservations through OpenTable, or reserve a parking spot through Parking Panda. You can also have dinner delivered straight to your front door through Grubhub (GRUB). The company connects hungry diners with more than 55,000 restaurants across around 1,200 U.S. cities through services like Grubhub, Seamless, and AllMenus. And based on its recent earnings report, more people are using Grubhub's services than ever before. Revenues rose 32%, net income rose 15%, and active diners rose 25% over the same period a year ago. As the U.S. becomes more and more "connected," the trend of on-demand food delivery should continue to boom... |

|

| The 'Google of China' continues to soar higher in 2017... This company's revenues could easily double over the next four years. And it should continue to earn large profits on those ever-increasing revenues... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

Expert predicts a breakthrough finger-touch app could create the largest company on the stock market, and turn every $5,000 investment into $20,000. Watch this 3-minute video clip. |

| I Can't Believe Smart People Can Be This Stupid | | By Dr. Steve Sjuggerud | | Monday, August 7, 2017 |

| | Whoa! I couldn't believe it when I read it! |

| | Wall Street Is Catching on to the 'Melt Up' | | By Justin Brill | | Saturday, August 5, 2017 |

| | Regular DailyWealth readers know Steve made a bold call last summer. It wasn't a popular call... But for those bold enough to take Steve's advice, the results have been nothing less than incredible... |

| | Don't Fall Into the Middle-Class Trap | | By Mark Ford | | Friday, August 4, 2017 |

| | I thought I knew what "middle class" meant... |

| | The 'Rolls-Royce' of Precious Metals Is at Its Biggest Discount Ever... | | By Dr. Steve Sjuggerud | | Thursday, August 3, 2017 |

| | There's the "silver" level... the "gold" level... and then what? |

| | The Biggest Downside to 'Buy and Hold' | | By Richard Smith | | Wednesday, August 2, 2017 |

| | The bull market in U.S. stocks is eight years old. It has been the gift that keeps on giving for "buy and hold" investors. But we aren't naïve. Eventually – whether it's next week, next month, or next year – a hurricane will hit the stock market. |

|

|

|

|