Editor's note: E-commerce giant Amazon has come a long way from its days as an online marketplace for books. And according to Joel Litman – founder of our corporate affiliate Altimetry – its evolution isn't over yet. In this article, adapted from a recent issue of the free Altimetry Daily Authority e-letter, Joel explains how this tech behemoth built its legacy... and why its biggest edge will help it thrive in the AI boom.

Amazon Is Bringing Its Biggest Edge to a New Arena By Joel Litman, chief investment strategist, Altimetry

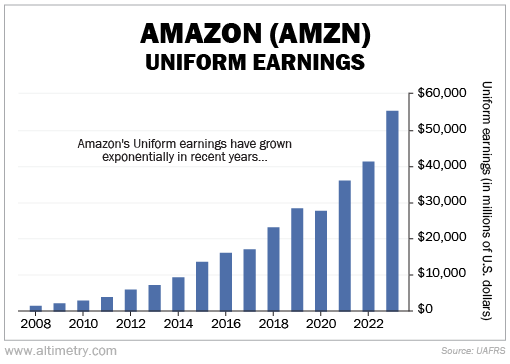

When Roland Brana signed up to sell his products on Amazon's (AMZN) marketplace, he didn't realize he was dooming his business... Brana is a motorcycle enthusiast from the U.K. In 1999, he started designing motorcycle boots and gear to sell online. He called his business "Bikers Gear." It was an instant hit. Within two years, he made enough money to open up a storefront in south Wales. Then, in 2002, Bikers Gear got its biggest break yet – an offer to sell on Amazon's new online marketplace. Up until that point, Amazon mostly sold books and videos directly to customers. But it was starting to team up with other businesses. The partnership was supposed to be a win-win. Third parties got to sell on a much larger platform... and Amazon got a little slice of the sales. And for years, it went exactly as Brana expected. However, as I'll explain today, Amazon had bigger plans than just selling Brana's biker gear. It was after something far more powerful... data. By 2013, Brana was selling his products all over Europe... Amazon took notice. A few years later, it proposed a different kind of agreement. All Brana had to do was focus on making and delivering the goods. Amazon would handle the sales. Brana agreed. He never could have anticipated what came next... Almost immediately, he started getting such large orders that he couldn't fulfill them all at once. Amazon sometimes ordered more than €1 million worth of gear at a time. With Brana's supplier unable to handle all the demand, he scrambled to find a new one. He even had to take out a second mortgage on his home. It was the only way to scrape together enough cash for more supply at his warehouse. And right as he did that... the orders stopped coming. The next time Brana checked Amazon's website, he noticed something odd. His products were still available... but he hadn't supplied them. Brana ordered some of the new stock. When it arrived, his worst fears were confirmed. Amazon was selling almost the exact same product with a different logo on it. Once Amazon had Brana's data, it didn't need his partnership. The original manufacturer reached out to Amazon... and the two teamed up to circumvent Brana's business. Bikers Gear went belly-up less than a year later. This is an awful outcome for small-business owners like Brana... and unfortunately, it's not uncommon. It's also the regrettable nature of the strategy that made Amazon the biggest e-commerce platform on the planet. Amazon is obsessed with using consumer data to maximize its business. The company's marketplace lets it collect endless amounts from users and third-party sellers. It thrives on that data. It has far more than you likely realize. And whether or not you agree with the ethics behind this strategy, it's a ruthlessly successful business model... Amazon has been collecting vendor data like this for decades. And the more data it collects, the more ways it can make money on that data. It started with stories like Roland Brana's... where Amazon was able to cut out the "middleman" and sell products directly. Now, it's also using all of its data to build its own artificial-intelligence ("AI") products. You've likely already seen some of these tools in use today... For example, Amazon uses AI to summarize product reviews on its e-commerce platform into easy-to-read "highlights." These highlights provide users with the most relevant information regarding product features and customer sentiment. The company is also building the same kinds of AI technology that Alphabet (GOOGL) and Microsoft (MSFT) have unveiled, such as AI models and chatbots. Plus, Amazon's cloud-computing subsidiary, Amazon Web Services, has several of its own AI tools... including a chatbot called Amazon Q. It answers questions, provides summaries, and generates content. There's even an AI transcription tool called Polly that can turn text into speech. The more ways Amazon has found to use this data, the faster its earnings have grown... At Altimetry, we analyze earnings with Uniform Accounting to avoid the distortions of traditional accounting methods. In the chart below, you can see the company's Uniform earnings since 2008. And while earnings grew slowly at first, that growth has ramped up in recent years. Amazon made about $1.6 billion in Uniform earnings in 2008. By 2014, that number had reached about $9.4 billion. Yet, in just the past decade, Amazon has grown its Uniform earnings sixfold. Take a look...

There's no doubt that Amazon's earnings will continue to impress. It has one of the most impressive treasure troves of data on Earth... which will allow it to carry on as a leader in the AI race. That said, Amazon isn't the only company that benefits from this emerging technology... We're still in the early stages of AI investment here in the U.S. Companies all across the economy stand to profit. For one, AI uses a ton of power... so the U.S. is building up its energy supply as fast as it can. Power companies will profit in a big way. AI also requires all kinds of infrastructure investments to work properly. It needs physical data centers to store all that data. (While Amazon Web Services exists in the "cloud," it still relies on real servers and hardware.) That's a huge boon for infrastructure companies. Simply put, the AI boom will have a lasting impact on the economy. And while you don't need to buy the hottest AI stocks to take advantage of this trend, you do need to exercise caution... Behind the AI buildup is a single, dramatic event that's set to shake up the entire stock market (and completely blindside investors). That's why I recently sat down to discuss the details in an online "AI Panic Summit." I revealed the AI bombshell no one is talking about... and the No. 1 step you need to take with your money today. Click here to learn more. Regards, Joel Litman

Editor's note: Joel famously predicted the financial crisis in 2008. And now, he's sounding the alarm on a similar panic unfolding on Wall Street... Again, a huge AI event is about to take place that will shock the market. It could have dire implications for unsuspecting investors. But Joel's research shows there's a way to protect your wealth – and even get positioned for 1,000%-plus potential upside. If you own any stocks, this is a message you can't afford to miss... Click here to learn the details. Further Reading Semiconductor companies must often fight for dominance in the market. But one "microchip serf" discovered how to distinguish itself against its competitors – and managed to solidify its place in the market as a king... Learn more here. Big Tech is already spending hundreds of billions of dollars on the AI megatrend. This kind of spending is good news for the overall stock market. Plus, it tells us we're a long way from an AI "bubble"... Read more here. |

|