| Bloomberg Morning Briefing Americas |

| |

| Good morning. We’re still talking tariffs, even if there’s some respite. What’ll China do next? How’s inflation looking? Billionaires had a great day yesterday. And if you’re looking to make the most of a layover, we know just the spot. Listen to the day’s top stories. |

|

| Markets Snapshot | | | | Market data as of 06:38 am EST. | View or Create your Watchlist |

| | Market data may be delayed depending on provider agreements. |

|

| |

| |

|

In China, leaders are meeting to discuss additional economic stimulus, people familiar said. Financial regulators will also be talking about how to support the economy and stabilize markets. Goldman Sachs lowered its China growth forecasts though, indicating it’ll be difficult for Beijing to fully offset the negative effects of tariffs.

Federal Reserve officials are prepared to hold their policy rate steady to minimize the risk that Trump’s tariffs trigger a persistent rise in inflation, even if the labor market softens further. Minutes from their meeting last month showed they were already starting to be worried about stagflation. One official, Neel Kashkari, said the bar for lowering rates is higher now.

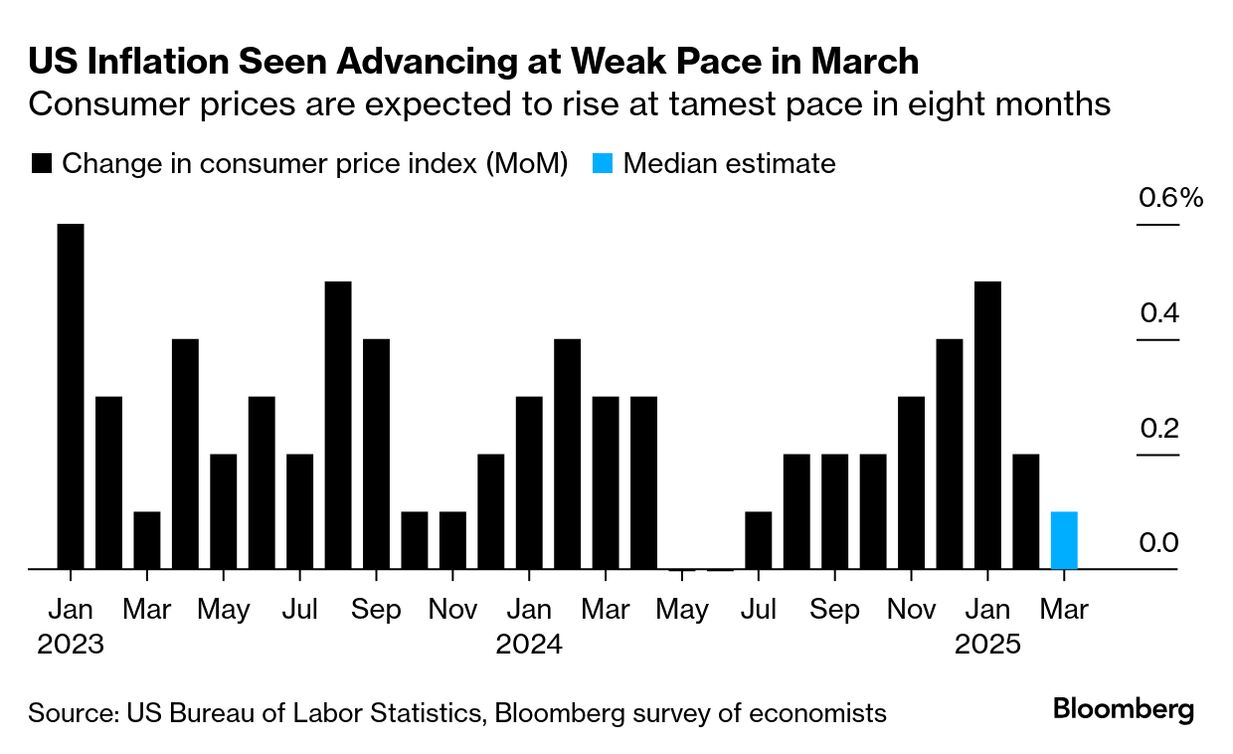

And speaking of inflation, we get monthly CPI data today. US inflation probably stepped down in March, thanks in part to a drop in energy costs, offering some relief to consumers before tariffs filter through. The index is seen rising 0.1% from February, according to a Bloomberg survey of economists.

|

|

Deep Dive: Billionaires’ Best Day Ever |

|

Photographer: omersukrugoksu/iStockphoto Markets were hectic for most investors yesterday, but very, very good for the rich. |

|

| |

| |

| |

| Listen |  | |

|

|

| Bloomberg Tech: Join top tech decisionmakers and influencers on June 4-5 in San Francisco. Decode technology’s evolving role across business, culture and healthcare as we discuss the advances transforming industries and how they impact society. Learn more. |

|

| |

| In the wake of Trump swerving on tariffs, for everyone but China, it’s best not to assume that the only way from here is up, John Authers writes. Game theory suggests we’re potentially set for a prolonged trade conflict. |

|

| More Opinions |  | |  | |

|

|

| |

The Forest Valley garden in the Jewel Changi Airport. Photographer: Wei Leng Tay/Bloomberg Singapore’s Changi reclaimed its crown as the world’s best airport in 2025, bumping Doha off the top spot in the Skytrax World Airport Awards. No surprise here, but US hubs continued to perform poorly. The highest ranked, Houston’s William P. Hobby Airport, came in 27th. |

|

| A Couple More |  | |  | |

|

|

| Enjoying Morning Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: - Markets Daily for what’s moving in stocks, bonds, FX and commodities

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Supply Lines for daily insights into supply chains and global trade

- FOIA Files for Jason Leopold’s weekly newsletter uncovering government documents never seen before

Explore all newsletters at Bloomberg.com. |

|

| |

Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. |

|

| You received this message because you are subscribed to Bloomberg's Morning Briefing: Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. |

|

|