|

|

Today’s Letter Is Brought To You By A Golden Visa for the Bitcoin-Forward Investor!

Bitizenship helps Bitcoiners secure EU residency and a path to Portuguese citizenship, without abandoning their long-term thesis.

Bitizenship Helps You:

✔ Unlock visa-free travel across Europe

✔ Secure residency with minimal physical presence

✔ Maintain Bitcoin exposure through a regulated structure

✔ Set up a future-proof Plan B for your family

✔ Gain one of the world’s strongest passports in 5 years

Time-Sensitive Update: Portugal may pass new citizenship rules within the near future, doubling the timeline to 10 years.

Lucky for you, there’s time to lock in the current law if you act now.

To investors,

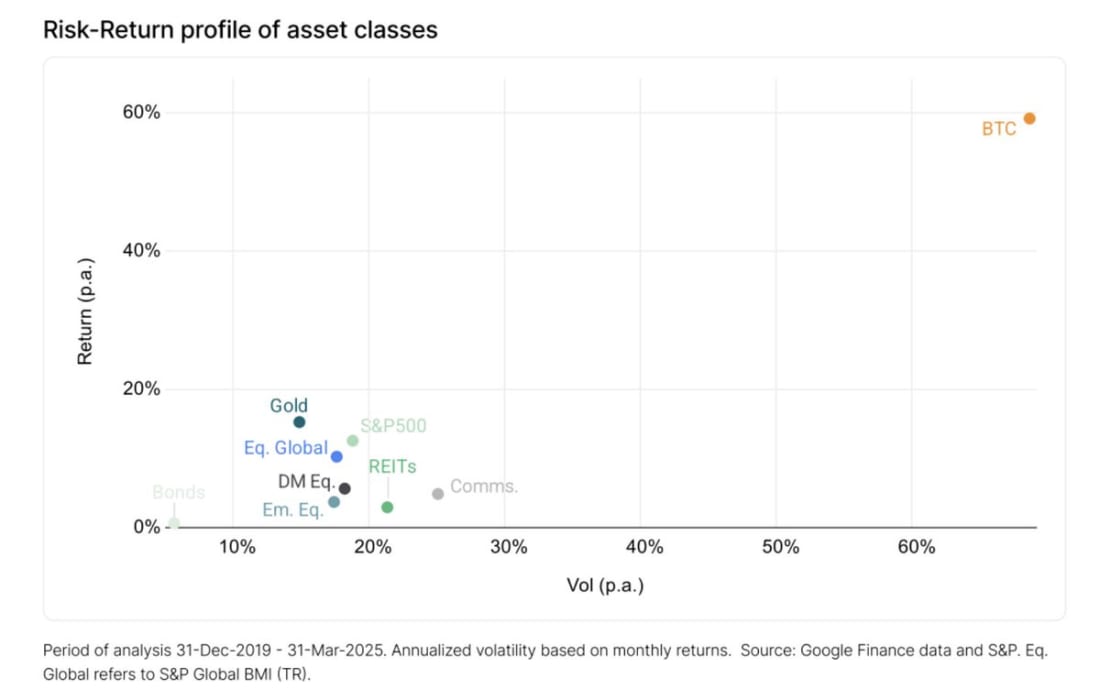

The holy grail of investing is to find asymmetric assets that present a more attractive risk-reward trade-off than other opportunities. Anyone can grab a significant return from time-to-time if they are willing to take immense risk. It is much harder to drive outsized returns when you account for the risk you are taking.

This is why bitcoin has become such an incredible asset for investors to add to their portfolio. Take a look at this chart that was shared by Bitwise’s Matt Hougan:

Quite literally, bitcoin is in a class of its own. There is not another asset even in the same zip code as the world’s largest digital currency.

Bitcoin has appreciated 93% in the last year, 1,096% in the last 5 years, and 38,122% in the last decade. The compound annual growth rate for the last 5 years is 64%. These are video game numbers for traditional investors.

But the more impressive part is how Bitcoin’s sharpe ratio stacks up against other assets. According to Case Bitcoin, bitcoin’s 5-year sharpe ratio is 1.34. Compare this to gold (0.96), stocks (0.81), and treasuries (-0.56).

See here is the thing — most retail investors ask themselves how high an asset can go. That is obviously an important question, but the more sophisticated investor asks themselves “how much can I make given the risk I have to take?”

And there is no better answer to that question than bitcoin. Literally nothing else compares. Bitcoin is the story of our generation. A decentralized, digital asset has grown from nothing into a multi-trillion dollar asset. You have the likes of Larry Fink, Paul Tudor Jones, and Stanley Druckenmiller all sharing the same talking points as your crazy libertarian uncle.

Bitcoin won’t stop going up until they stop printing money and it seems obvious now that they are never, ever going to stop printing money.

Hope you all have a great day. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Bitcoin Is Taking Over Wall Street

Anthony Pompliano and John Pompliano discuss everything that is happening with bitcoin, why bitcoin ETFs are making more money than S&P EFTs, US dollar collapse and what that means for asset prices, why Elon Musk wants to start a new political party, and how this all affects your portfolio.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

Bitizenship – Get EU citizenship through Portugal’s Golden Visa, maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp.

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadot - is a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.