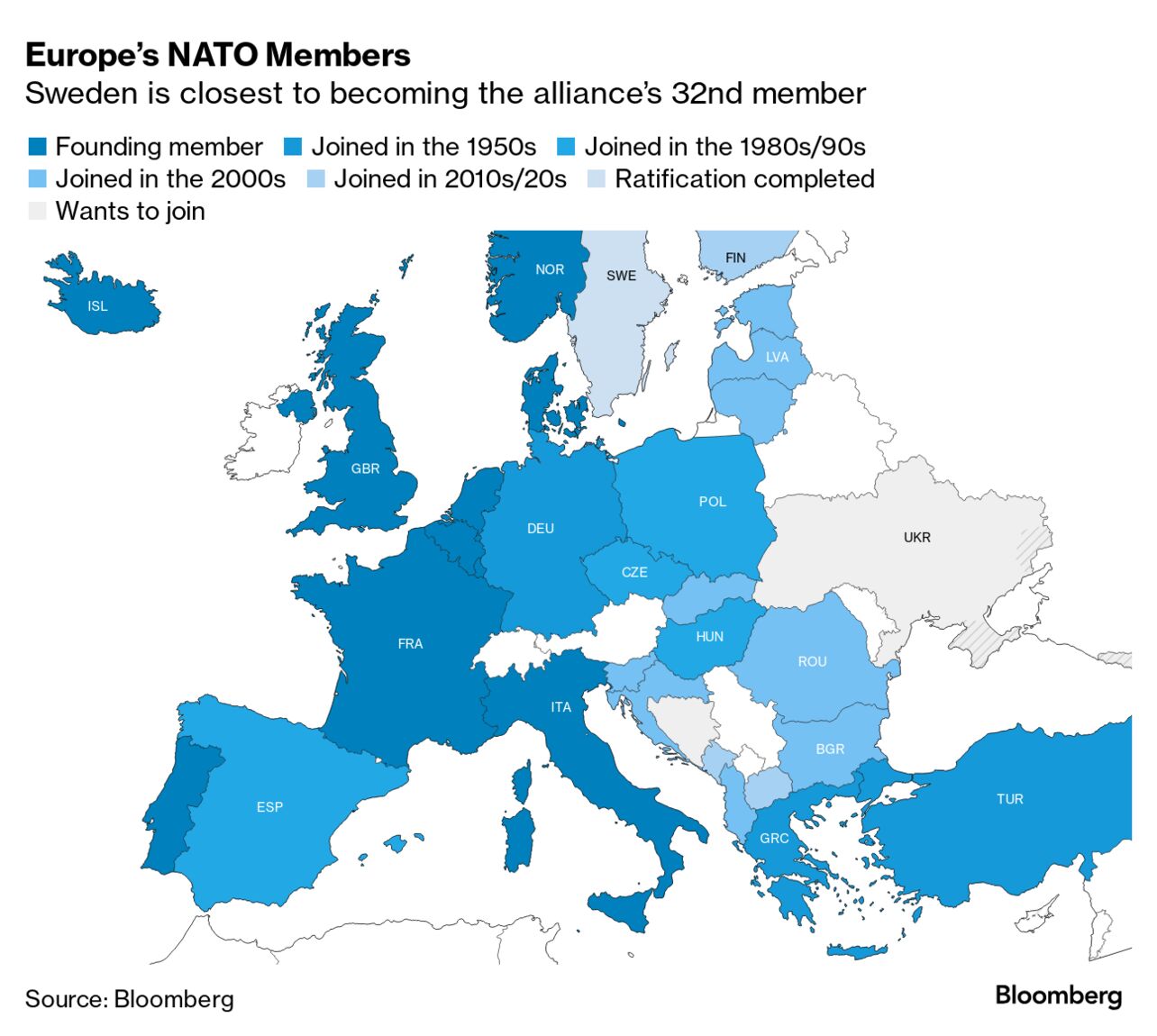

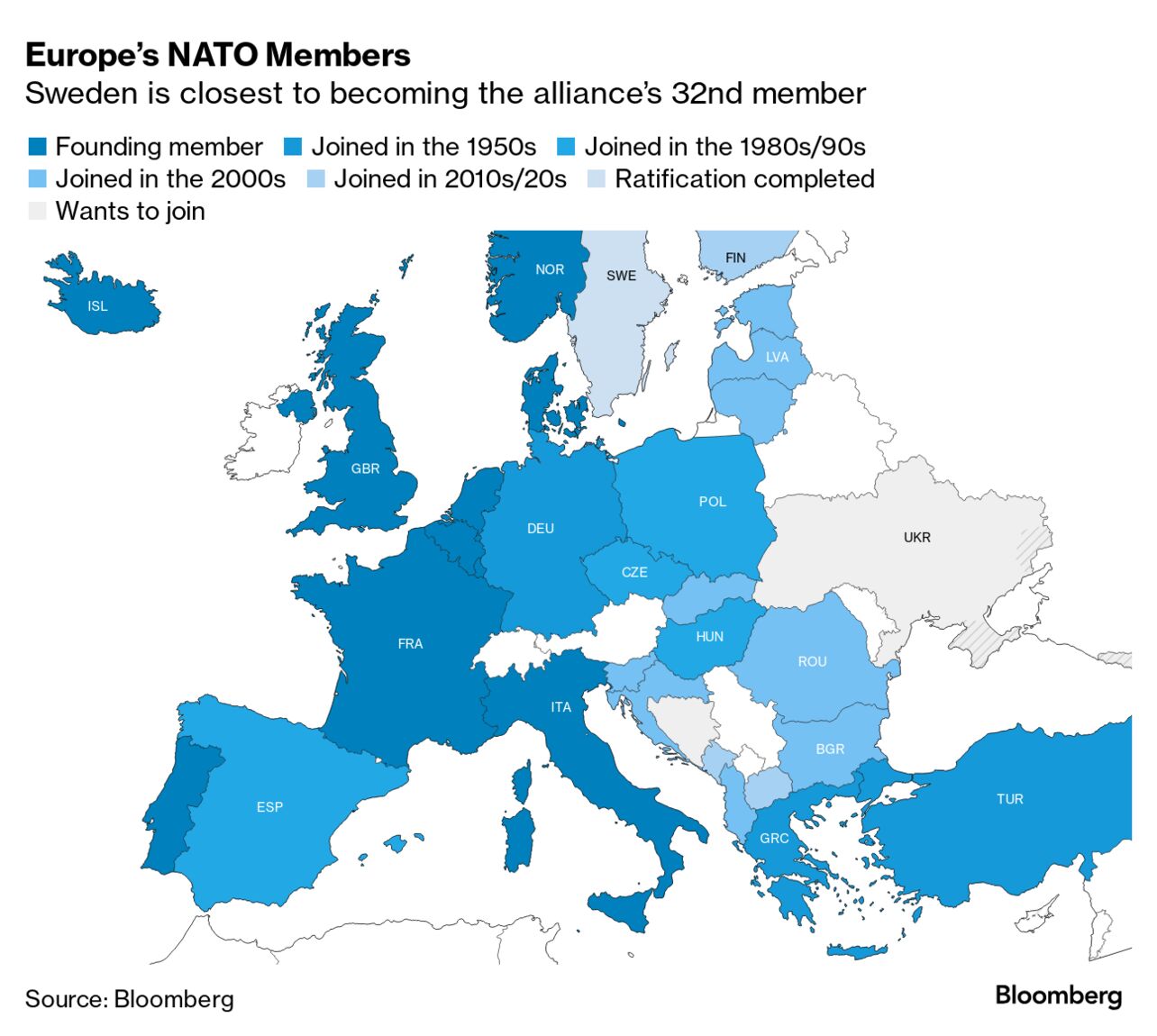

| US regulators issued a scathing report on Boeing’s safety culture, putting further pressure on the company as it contends with the fallout from a near-catastrophic accident at the start of the year. The US planemaker was faulted for ineffective procedures and a breakdown in communications between senior management and other members of staff, according to the long-awaited report released Monday by the US Federal Aviation Administration. Constant changes to complex procedures and trainings led to confusion, a panel of safety experts found. The report is the latest to find fault with safety at Boeing, which suffered its latest blow when a panel covering an unused door flew off during an Alaska Airlines flight on Jan. 5. The 50-page report highlights the work still to be done at Boeing despite efforts to overhaul its culture and bolster safety practices after two fatal 737 Max crashes in 2018 and 2019 killed 346 people. —Natasha Solo-Lyons Sweden cleared the final obstacle to gaining NATO membership in a move that will solidify the alliance’s grip over Northern Europe and the Baltic region. The approval by Hungary’s parliament on Monday came 21 months after the Nordic country submitted its membership bid jointly with Finland in response to Russia’s invasion of Ukraine. Sweden’s accession into the North Atlantic Treaty Organization helps bolster Europe’s security amid rising concerns Russia could try to target the bloc’s members.  As the best hedge fund strategy of 2023 becomes a magnet for mainstream investors, the risk models it relies on are getting a lot tougher to crack. The strategy in question is tied to insurance-linked securities, which are dominated by catastrophe bonds. In 2023, no other asset class produced a better-performing bet for hedge funds, with firms including Fermat Capital Management and Tenax Capital booking their biggest-ever returns. But calculating catastrophic risk is much more complex than it used to be. Citigroup hired JPMorgan’s Viswas Raghavan as head of banking and executive vice chair, poaching from a key rival as Chief Executive Officer Jane Fraser presses ahead with the bank’s biggest restructuring in decades. Raghavan, who is expected to start at the bank in the summer, will also join the firm’s executive management team and report directly to Fraser. JPMorgan elevated Doug Petno and Filippo Gori to lead global banking, the first management shuffle under new commercial and investment banking co-heads Jenn Piepszak and Troy Rohrbaugh. Members of the Walton family sold roughly $1.5 billion worth of Walmart stock at the end of last week as shares hovered near a record high. The Walton Family Holdings Trust sold about 8.82 million shares between Feb. 21 and Feb. 23, according to US Securities and Exchange Commission filings from late Friday. Walmart has climbed about 13% this year, outperforming the 3.2% advance in the S&P Retail Select Industry Index. Tech giants are racing to ward off a carbon time bomb caused by the massive data centers they’re building around the world. A technique pioneered by Google is gaining currency as more power-hungry artificial intelligence comes online: Using software to hunt for clean electricity in parts of the world with excess sun and wind on the grid, then ramping up data center operations there. Doing so could cut carbon and costs.  Steam rises above cooling towers at a Google data center in The Dalles, Oregon. Photograph: Bloomberg Donald Trump filed notice that he’s appealing New York state’s $454 million civil fraud verdict over his company’s asset valuations, kicking off a fight that could drag out for months or longer. But the appeal does nothing to slow the expensive, ticking clock the Republican faces as he delays forking over the money. The fine is increasing by almost $112,000 in interest each day, and his decision to challenge the verdict instead of paying it poses the risk it could balloon even more. Jamie Dimon said problems in commercial real estate will be contained to “pockets” of the sector as long as the US avoids a recession. Many property owners can handle the current level of stress, the JPMorgan chief executive said on CNBC Monday. Lower valuations tied to higher interest rates is “not a crisis, it’s kind of a known thing,” he said.  Jamie Dimon Photographer: Ting Shen/Bloomberg The world’s biggest electric vehicle seller has debuted its most expensive car: a 1.68 million yuan ($233,450) high-performance fully-electric supercar. BYD says the Yangwang U9 can hit 100 km/h (62 mph) in 2.36 seconds and reach a top speed of 309.19 km/h. Here’s a closer look at the Chinese supercar that’s taking on the likes of Ferrari and Lamborghini.  A BYD Yangwang U9 electric vehicle Photographer: Qilai Shen/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Power Players Jeddah: Set against the backdrop of the Formula One Saudi Arabian Grand Prix, Bloomberg Power Players Jeddah on March 7 will bring together some of the most influential voices in sports, entertainment and technology as we identify the next potential wave of disruption for the multibillion dollar world of sports, media and investment. Join powerbrokers, senior executives, leading investors and world-class athletes who are transforming the business of sports. Learn more. |