| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. |

|

Let’s take another look at the underlying factors arguing for much higher gold prices over the years to come. |

|

Everything seemed so certain just a few days ago. | As attendees for our recent New Orleans Investment Conference know, our 50+ expert speakers reached a rarely seen consensus: The case for higher gold prices over the years to come was inarguable…irrefutable…irresistible.

In other words, everyone agreed that gold was headed upward and there was nothing that could stand in its way.

And when asked what my greatest worry was, I had to admit it was precisely this level of unanimity. | Now, after gold was thrown backward by the announcement of a potential Covid-19 vaccine, many are suddenly questioning the previously bright prospects for gold. | So was this a contrarian’s triumph, when the masses actually were dreadfully wrong?

It’s times like these that my great friend and mentor Jim Blanchard would counsel investors to take Ayn Rand’s advice and “check our premises.”

That means an objective, dead-honest review of your argument, faithfully re-examining every pillar of evidence and logic supporting your conclusion.

With gold trying to recover from Monday’s shellacking and struggling to regain its uptrend, it seems like a good time for us to undertake this process. | | The easiest argument to check is the time frame. Our thesis that the macro picture is tremendously bullish for the metals is focused on the long-term.

Anything that happens over the short term — especially something like a vaccine announcement that we already knew was going to be a speed bump — is completely irrelevant to our focus on the horizon.

So have no fear over a vaccine, which is good news for the world, and how it might affect the market’s expectations of stimulus spending in the weeks just ahead.

What we’re focused on is the solid macro set-up for gold. And it’s here where we need to consider the most dominant factor supporting our thesis… | | Yes, a decade-plus of zeroed interest rates (punctuated by an aborted attempt to modestly raise them) led to tremendous, mind-boggling currency creation and liquidity injections into the financial system.

That alone is a solid bullish argument for gold and silver.

But interest rates at 5,000-year lows, along with bail-outs and stimulus spending to rescue economies, also encouraged massive sovereign, corporate and individual debt creation.

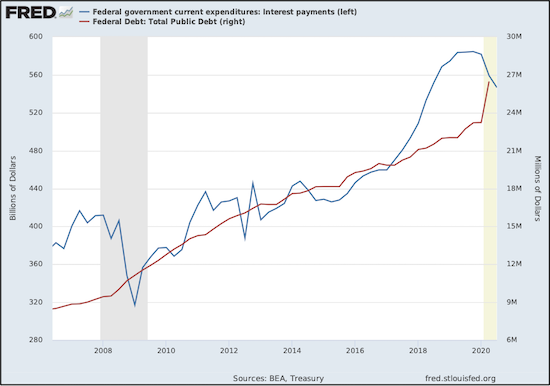

Our thesis for higher gold prices rests on the argument that these debt loads have grown to such monumental and unmanageable levels that they absolutely preclude any significant increases in interest rates. | In fact, they actually require that rates are negative on a real (inflation-adjusted) basis. Otherwise, the debt service costs will quickly overwhelm federal budgets. | To illustrate this, let’s focus on the U.S. and take a look at two compelling charts. First, let’s consider the relationship between the federal debt and the government’s annual interest payments on that debt. |  | As you can see, the debt service costs (in blue) seem to be related to the size of the federal debt (in red) over the long term, but show a couple of short-term periods where those costs plummeted even as the debt was soaring.

Those instances were in the 2008 Great Financial Crisis and this year’s Covid-19 economic shutdown. In both cases, the Fed rapidly dropped interest rates to zero in response to the economic emergencies.

What’s really striking in this chart is how the federal debt soared this year, yet service costs on that debt simultaneously dropped like a rock.

Our following chart shows why…. |

|

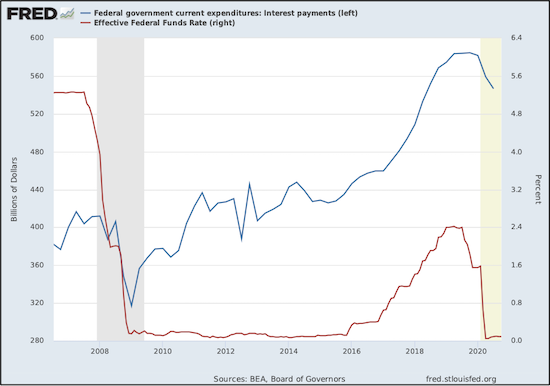

| In this chart you can see that federal interest payments (in blue) are tremendously responsive to changes in the effective fed funds rate (in red).

This seems to be comforting at first glance, since our debt service costs have dropped so significantly. | But it’s not so reassuring when you notice how debt service costs are also highly leveraged to the upside. | Consider how much those costs rose during the Fed’s very moderate and short-lived attempt to raise rates. They were only able to get the fed funds rate to 2.4%, yet interest payments soared by about 33%.

Moreover, the total costs haven’t dropped that much in response to the fed funds rate returning to zero, arguing for levels of $750 billion or more if the Fed ever tries to raise rates only to that previous 2.4%. (And that itself is less than half of an historically normal rate.)

Now consider that this projection is based on the current level of debt. As we know, the federal debt is continuing to soar. At its current trajectory, which doesn’t seem likely to moderate under the political climate going forward, the debt could approach $40 trillion by the end of the next presidential term.

The power of large numbers, multiplied by the leverage of interest rates on such large numbers, means that the U.S. would pay well over $1 trillion in interest payments alone if interest rates are only mildly positive on a real basis. | In today’s political environment, do we really believe the public will accept paying over a trillion dollars each year to fat-cat bond holders? | This means the Fed has to guarantee negative real rates, by hook or by crook, for essentially as long as this monetary regime is in force.

And if they lose control of rates, if the market demands higher returns for the obviously higher risks, that will only make the Fed more desperate…and/or lead to a foundational monetary reset.

The latter would likely involve gold in some way that would dramatically revalue it in relation to the dollar.

In short, this is the big picture: The Fed is painted into a corner, and simple math means we must have negative real rates going forward — a tremendously bullish support for gold and silver.

Regardless, and in any imaginable scenario going forward, it seems that the price of gold must rise in relation to the dollar (and every other fiat currency).

The premise seems to pass under examination…and make the current gold-price fluctuations irrelevant. | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

|

|

|