I'm a firm believer that combining technical analysis (chart patterns) with fundamental analysis (a deep understanding of the company and the numbers) is the secret to success in the markets. Either one in isolation can get you into serious trouble. Together, you would be amazed at the results you can achieve.

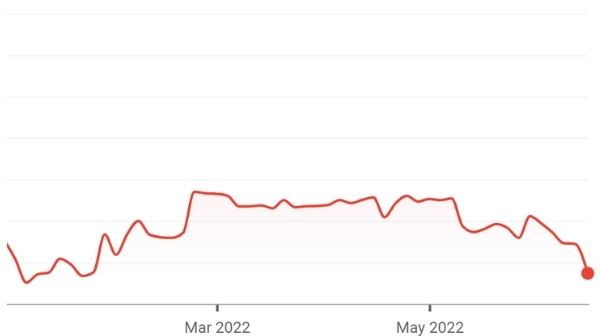

While researching today's feature article on Barloworld, I noticed a particularly unusual chart pattern in the share price this year. I'm not sure the Table Mountain pattern is found in many textbooks:

The trick is to figure out whether that share price is headed for the Sea Point Promenade or not. Barloworld has recognised a R1 billion impairment in Eurasia (mainly because of Russia) but is pushing through in that coun try. It's a very interesting situation that those with higher risk appetite may wish to take a view on. You can read all about it here.

A far less risky business is Dis-Chem, which is marching on with a growth strategy that has many interesting levers. I still think the share price is too expensive, yet that chart keeps heading to the top right corner of the page. To understand why I believe it is a better bet than Clicks, read this feature article on the results.

For the rest of the JSE company updates on the market, you can always refer to the daily Ghost Bites article. There were several important results announcements.

Wichard Cilliers, Head of Market Risk at TreasuryONE, gives us this update on the rand:

"The rand enjoyed the weakness in the US dollar yesterday, as the local unit traded all the way to R15.65 against the US dollar. We expect the currency to run into some headwinds as any move lower will be met by some resistance. Most of the other emerging market currencies traded in the same direction as the rand, which purely makes this a US dollar play, and no new momentum is coming for the rand itself. We will await the US Fed minutes on Wednesday as the big momentum giver for the week."

Indeed - the Fed is the one to watch!

For something completely different, you could consider Karbonyte's blockchain mining platform. It alternates between performing verifications on the blockchain and mining alternative coins on the Ethereum platform. To find out more, refer to this sponsored article.

Stay up to date with Magic Markets episodes by listening to Episode 76, in which Rob Grieve from Westbrooke Alternative Asset Management joined us to discuss the exciting world of private equity. As a South African who has moved to the UK, Rob also discussed the differences between the two private equity markets wi th us.

Have a terrific Tuesday!