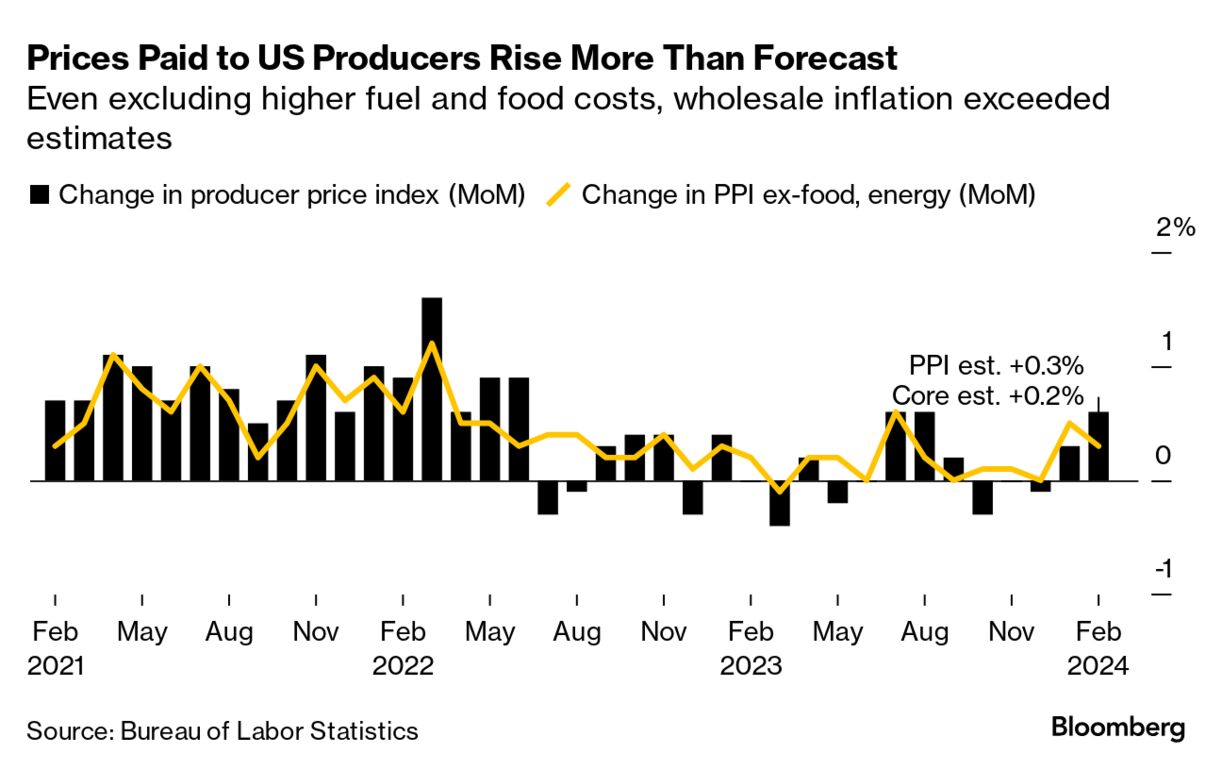

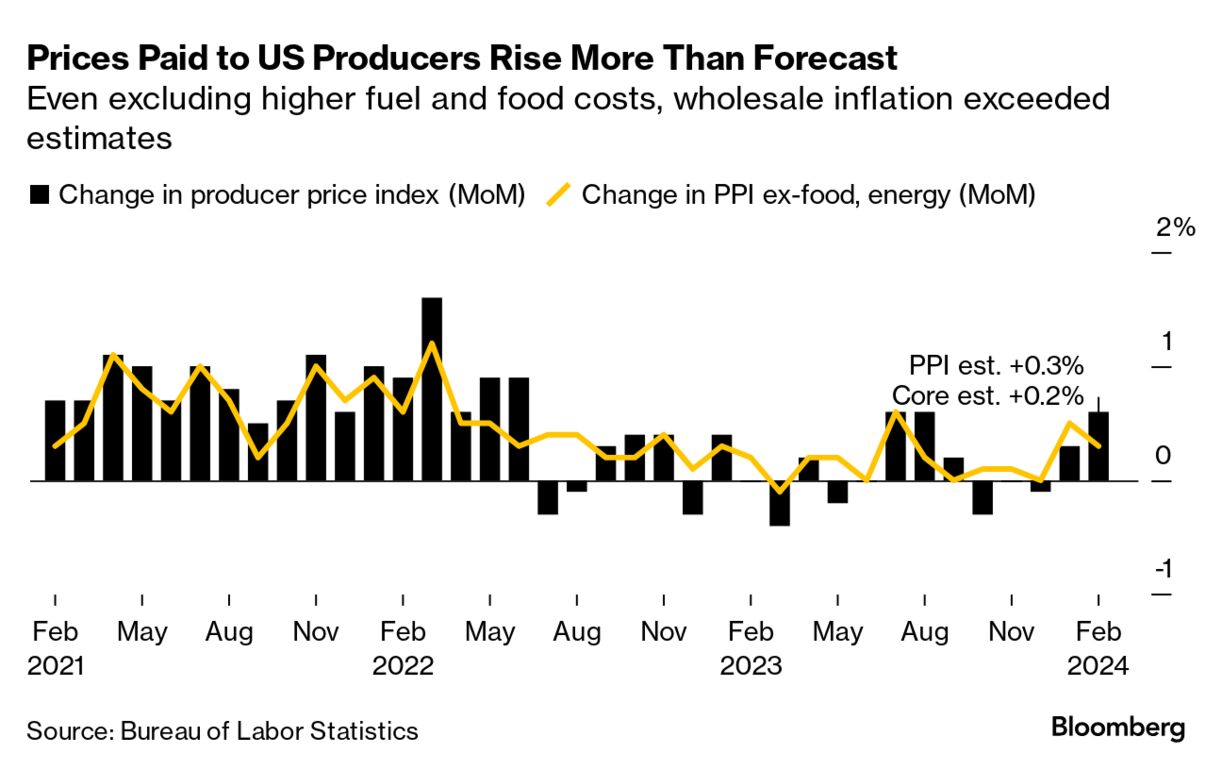

| Markets are showing the characteristics of a bubble, given the record-setting surge by the technology sector’s so-called Magnificent Seven stocks and the all-time highs in cryptocurrencies. This from Bank of America Chief Investment Strategist Michael Hartnett, who laid out his case on Bloomberg TV. The S&P 500 has reached record highs 17 times this year, with artificial intelligence darling Nvidia soaring more than 80%. And Bitcoin hit an all-time high for the fourth time in six days this week, bolstered by massive inflows into US exchange-traded funds tied to the cryptocurrency. That’s a lot of froth. Still, markets were down on Thursday. Here’s the wrap. —David E. Rovella The almost-daily trickle of information that could influence the US Federal Reserve one way or the other as to when it will start cutting rates continued today. Prices paid to US producers rose in February by the most in six months, driven by higher fuel and food costs, new data show. The producer price index for final demand increased 0.6% from January, according to the Labor Department. The gauge rose 1.6% from a year earlier, the largest annual advance since September. Consumer-price data earlier this week showed underlying inflation exceeded forecasts for a second month, also reaffirming expectations that the Fed will be in no rush to reduce interest rates.  Millennium Management, one of the world’s biggest hedge funds, is said to have made tens of millions of dollars when Egypt allowed its currency to weaken after a successful bet by one of its senior traders. Naveen Choppara, who joined Millennium in Dubai last year, wagered that Egypt would allow the devaluation in order to stave off an economic crisis. When the pound tumbled 38% on March 6 after the country’s central bank introduced a record interest-rate hike, he scored close to $40 million. Senate Majority Leader Chuck Schumer reached his breaking point Thursday with Israeli Prime Minister Benjamin Netanyahu. Schumer, the highest-ranking Jewish elected official in the US, called for new Israeli elections and the replacement of Netanyahu, an extraordinary public rebuke that reflects a reexamination among Democrats of close bonds with Israel amid the five-month Gaza war. “I believe a new election is the only way to allow for a healthy and open decision-making process about the future of Israel,” Schumer said on the Senate floor. Netanyahu, he said, “has lost his way” and become beholden to right-wing extremists.  Chuck Schumer Photographer: Tierney L. Cross/Bloomberg Steven Mnuchin, former Treasury Secretary for Donald Trump, is targeting a purchase of TikTok from its Chinese parent company just one day after House lawmakers passed a bipartisan bill that would ban the wildly popular social media app in the US. Mnuchin has spoken to potential co-investors about acquiring TikTok, he said in an interview with CNBC on Thursday, declining to give any specifics. US lawmakers are pushing for a ban of the app unless its owner ByteDance divests it, driven by concerns over Chinese government influence on the American public. Citigroup placed a senior dealmaker within its equity capital markets group on leave as the firm is said to investigate a complaint regarding a verbal altercation with a junior banker. Edward Ruff, a New York-based managing director in the investment banking unit that handles initial public offerings and other stock deals, was suspended from work in January and has yet to return. Ruff is said to have publicly berated a junior banker, who is a person of color, in the office, leading to a complaint about the language he used. Kenya’s shilling has staged a comeback that’s vaulted it from one of the worst to the best in the world in less than three months. As recently as Jan. 26, the shilling was the third worst performer globally, plumbing a record low versus the dollar. Since then, it has rebounded more than 20%, aided by a mix of factors including a new eurobond issue. Its year-to-date gain puts it far ahead of the world’s second-best performer—the Sri Lankan rupee—which has strengthened 6.1%. Maybe Rishi Sunak won’t make it to the election. That’s what some of his ministers appear to be mumbling. Since becoming the UK prime minister 16 months ago, he has had support from the vast majority of Conservative politicians who were convinced another change of leader would do more damage than keeping him. Now some senior Tories arestarting to reconsider.  Rishi Sunak Photographer: Peter Nicholls/Getty Images Back in the day, a professional athlete played, maybe made some money and then hung it up. When they retired, there was a chance to work for a local company to leverage whatever fame they had accrued. But a few players have realized there is much more to be done both before and after the final whistle blows. That’s where Constance Schwartz-Morini comes in. On the latest episode of The Deal with Alex Rodriguez and Jason Kelly, we speak with this National Football League executive-turned-manager who’s worked with everyone from Snoop Dogg to Erin Andrews—not to mention Michael Strahan and Deion “Prime Time” Sanders.  Constance Schwartz-Morini Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Technology Summit: Led by Bloomberg Businessweek Editor Brad Stone and Bloomberg TV Host and Executive Producer Emily Chang, this full-day experience in downtown San Francisco on May 9 will bring together leading CEOs, tech visionaries and industry icons to focus on what's next in artificial intelligence, the chip wars, antitrust outcomes and life after the smartphone. Learn more. |