|

To investors,

There was a flurry of new legislative bills related to foreign conflicts that made progress in recent days. Although it seems absurd to send nearly $100 billion abroad while the United States has significant domestic issues that have gone unaddressed, there is one detail in these bills that really caught my attention — the REPO Act.

According to NBC News, here is what the REPO Act entails:

“The House passed a foreign aid package Saturday as well as what's called the REPO Act, which would allow the Biden administration to confiscate billions of dollars’ worth of Russian assets sitting in U.S. banks and transfer them to Ukraine for reconstruction….

The REPO Act, which would authorize Biden to confiscate the frozen Russian assets in U.S. banks and transfer them to a special fund for Ukraine, is part of the foreign aid package that was stalled for months in the House. More than $6 billion of the $300 billion in frozen Russian assets are sitting in U.S. banks. Most of the $300 billion in assets are in Germany, France and Belgium.”

This is noteworthy because the United States is essentially planning to take money from the Russian people to give to the Ukrainian people.

CrossBorder Capital’s Michael Howell said it best: “Whatever the compelling moral case, the economic impact of April 20th's decision could match August 15th, 1971 when Nixon took US off gold.” Personally, I can’t think of another example of something this severe happening in my lifetime.

While the United States and her allies are optimizing for the short-term in Ukraine, we are essentially pushing every country to consider gold, bitcoin, or other non-fiat currency assets to hold as a growing percentage of their central bank reserves. The freezing and/or confiscation of one country’s assets will lead to many countries creating structures that minimize this risk for them in the future.

Remember, gold’s price was pushed up to a new all-time high within 48 hours of the Iranian missile attack on Israel. We still don’t know who was buying so much gold in the days leading up to the attack. That feels like an increasingly important question to answer.

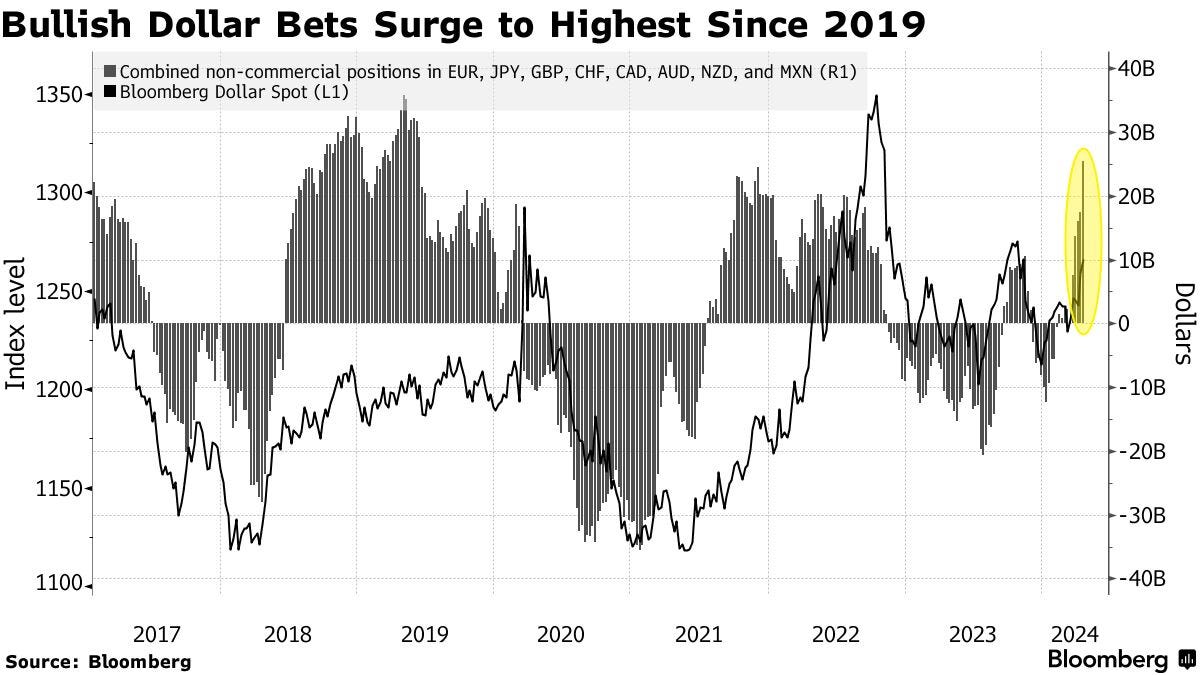

This geopolitical chess game is all happening against a backdrop of the strengthening dollar. According to Bloomberg:

“[The] dollar index has gained more than 4% this year, reflecting advances against all major developed and emerging-market counterparts. One popular gauge of trader sentiment pointed bearish at the start of the year, but has since flipped to become the most bullish since 2019, according to data from the Commodity Futures Trading Commission.”

We are also seeing aggressive buying of stocks for the first time in weeks, despite all the chaos on the geopolitical stage. Bloomberg’s Jan-Patrick Barnert writes:

“Hedge funds are getting back to buying global equities, shrugging off broader market volatility to gobble up tech stocks at the fastest pace in two months, according to Goldman Sachs Group Inc.’s trading desk.

New long positions outpaced short sales last week while single stocks saw “the largest notional buying in over a year,” the traders wrote in a note, marking a bullish turn in sentiment after hedge funds had been selling for the prior three weeks.

The funds were loading up on stocks even as investors retreated to havens on the prospect of a delay in Federal Reserve rate cuts and rising geopolitical risks, with the tech-heavy Nasdaq 100 recording its worst week since November 2022.”

So the stage is set for more uncertainty in the coming months.

The Federal Reserve has lost the fight against inflation and is too scared to raise rates higher after their promise of incoming rate cuts. The consumer across the American economy is spending like it is 2021. The largest countries in the world are playing a game of chicken across various conflicts. Central bank assets have now become the possession of whoever touched them last. And the United States is preparing to hold an election between two elderly candidates, including one that is being criminally prosecuted by his political rival.

The whole situation is insane. Investors have to ignore all this noise though. It won’t help you allocate capital any better. The short-term fear and uncertainty is not going to change the long-term trend of assets.

The US dollar will continue to be debased. The national debt won’t stop growing. Stocks will go up over the long-run. Bonds will continue to be a losing trade. Bitcoin can’t help but appreciate in price as the dollar is destroyed. And the citizens who invest, rather than save, will end up pulling away on the positive side of the wealth inequality gap.

We make not like the situation, but these are the cards we have been dealt. Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

-Anthony Pompliano

Reader Note: Today is a free email available to everyone. If you would like to receive these letters each morning, please subscribe to become a paying member of The Pomp Letter by clicking here.

Mark Yusko is the Founder, CIO, & Managing Director of Morgan Creek Capital Management. David Alderman is a Digital Asset Research Analyst at Franklin Templeton. Adam Sullivan is the CEO at Core Scientific.

This conversation was recorded at Bitcoin Investor Day in New York.

In this conversation, we discuss bitcoin halving, institutional demand, bitcoin miners, ethereum, and future outlook of crypto industry.

Listen on iTunes: Click here

Listen on Spotify: Click here

Panel Discussion on Bitcoin Halving

Podcast Sponsors

Core Scientific is one of the largest public Bitcoin miners and hosting solutions providers for Bitcoin mining in North America.

iTrustCapital allows you to buy and sell cryptocurrency in a tax-advantaged crypto IRA.

Supra- Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.