Click here for full report and disclosures

â Healthcare in focus: Across the world, the coronavirus pandemic has revealed that 1) existing healthcare facilities struggle to handle a sudden surge in demand, and 2) reliance on long-distance imports for crucial medicines and equipment can create a dangerous bottleneck. In response, governments are beginning to reinforce their healthcare systems. Beyond the near-term surge in spending to beat the virus, we expect sweeping regulatory changes, more healthcare spending and a more active trade and industrial policy to onshore production of key medicines and equipment. That crises reveal shortcomings which governments address thereafter is not news. The partial repair of the global banking system after the 2008/09 financial crisis is a case in point. However, there are crucial differences now.

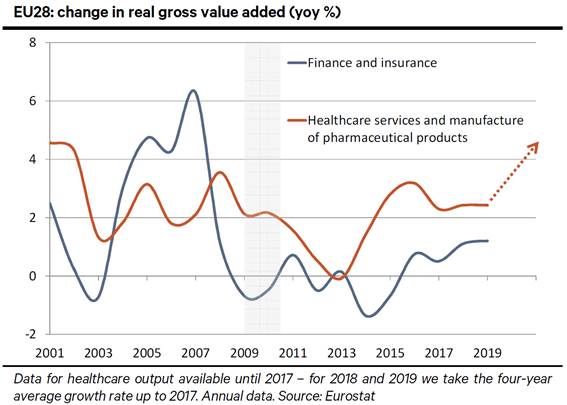

â Boom, bust, repair: During the 2000s, a boom in credit and shadow banking fuelled real estate bubbles across much of the advanced world. The bursting of the bubble revealed underlying fragilities that had been masked by the preceding boom. After the bust, regulators and policymakers tried, with differing degrees of success, to treat structural faults in the financial sector. Facing increased regulation and higher capital requirements, the European financial sector grew by just 0.7% from 2008 to 2019, compared to average annual growth of 3.5% in the decade prior – see the chart above. The resulting sluggish credit dynamics curtailed growth in other sectors of the economy as well. The need for fiscal repair also weighed on the expansion of healthcare.

â âFixingâ healthcare is different: Unlike repairing the financial sector, improving and reinforcing healthcare sectors across the world should not retard economic growth. First, with no past excesses to deal with, there is no payback in the years to come. No boom, no bust. Second, building a more resilient healthcare system will involve higher capital investment – in hospitals and factories – and more spending on research, doctors and nurses.

â Growth-enhancing? Better healthcare systems should lead to healthier societies. That should be beneficial for long-run productivity. But whether the building up of healthcare systems will raise growth in the next few years depends on two factors: 1) how much of the growth in the sector comes from higher investment (positive for potential GDP) versus redistributing labour to healthcare from other sectors (probably neutral); and 2) whether the public healthcare spending is deficit-financed (demand-positive) or budget-neutral. On balance, we expect a modestly positive impact.

â Cautious optimism for the post-coronavirus world: Beyond the likely changes in the healthcare sector, the post-coronavirus world will look very different to the post-Lehman world. Success in containing the worst second-round effects of the coronavirus will likely encourage governments to throw more money at other problems as well. In manufacturing, companies will shorten and diversify supply chains and raise inventories. But against this drag on global supply growth, the coronavirus shock is likely to spur innovation in many fields, ranging from more efficient use of labour and communications technology to increased use of 3D printing. In the long run, the resulting jolt to productivity may be stronger than the drags unless economic policies turn away too much from market-based models.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659