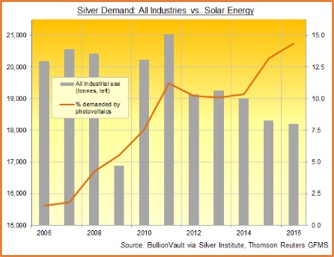

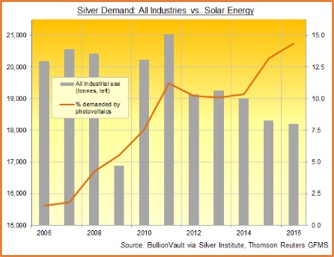

Photography Demand Slowly Being Replaced By Solar Industrial demand for silver has declined since peaking in 2011, largely due to the loss of traditional photography. Silver oxide is a key component of photographic film. With the bulk of photography now digital, demand for silver in the film industry has dropped substantially.

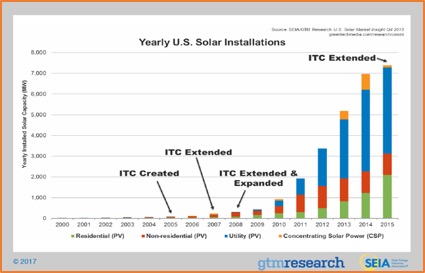

But solar is helping take up some of the slack.  77.6 million ounces of silver were used to fabricate solar panels in 2015, accounting for approximately 7% of total demand. With the solar cell market expanding 20% per year, we expect that number to climb significantly once the final numbers for 2016 are tallied. 77.6 million ounces of silver were used to fabricate solar panels in 2015, accounting for approximately 7% of total demand. With the solar cell market expanding 20% per year, we expect that number to climb significantly once the final numbers for 2016 are tallied.

Because silver is one of the best conductors of electricity known to man, silver paste is used as a conductor on both the front and back of crystalline solar cells. Roughly 120 to 150 milligrams are used for each cell. As demand for solar panels continues to grow, so should the demand for silver. Silver Demand Exceeding Supply Again One of the biggest conundrums for silver investors is its supply/demand profile.

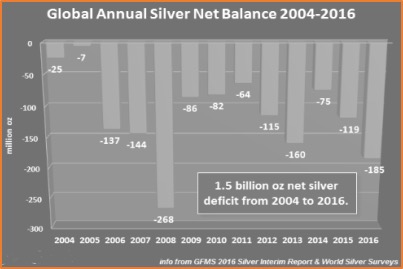

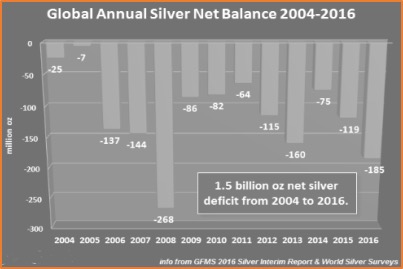

Consider that silver demand has exceeded supply for 12 straight years with seemingly little effect on price. Global silver demand hit a new record in 2016 — increasing 2.8%. At the same time, mine supply dropped 0.7% and total supply dropped 2.2%, down 6% from its 2010 peak.

With a cumulative deficit of 1.5 billion ounces from 2004 through 2016, one would expect the market to drive prices higher to encourage more production. That hasn’t happened.

The failure of silver to rally despite a growing supply deficit has led to a cottage industry based on the notion that silver prices are manipulated. We are not fans of easy answers. This makes us extremely wary of conspiracy theories in general and the silver manipulation argument in particular.

Silver does adjust to deficits but tends to do so rapidly, leaving all but the most dedicated bulls behind. Its volatile nature means price tends to overshoot fair value.

Consider that silver soared in 2010, rallying from just under $15 per ounce in early February to a high of $49.50 just 14 months later — an eye-popping gain of 230%.

Silver was too cheap at $15 per ounce and too expensive at $49.50 per ounce. One of the reasons it climbed so high in such a short span of time was the Fed. The Federal Reserve’s massive bond-buying stimulus plan affectionately known as Quantitative Easing (QE) began in 2008 in response to the financial meltdown caused by the housing crisis. In 2010, the Fed announced QE2, doubling down on the bet it made in 2008. This led to fears that the Fed’s actions would be inflationary. Both silver and gold soared as a result.

Producers used the massive 2010 rally in silver to lock in favorable prices by selling futures contracts. This and the failure of QEs 1, 2 and 3 to provide any meaningful inflation set the stage for the six-year bear market which followed, and which appears to be on the verge of ending.

Now that prices have drifted back to $17 per ounce, we would not be surprised to see another volatile upside adjustment. This might be in response to silver’s growing cumulative deficit and the potential for increasing inflation.

Data Source: Reuters/Datastream Inflation Is Not Dead The United States and China are the two largest economies in the world, accounting for 40% of global demand. Both are pursuing inflationary policies — the effects of which we may have just begun to feel. Nearly a decade of artificially-low interest rates in the U.S. have pumped over a trillion dollars into the economy. Much of this — so far — has either remained on the sidelines or been injected into the stock market.

Add to this trillions more from potentially budget-busting tax cuts and infrastructure spending. The Trump crackdown on immigration means there are fewer low wage workers available to fill positions. Visa restrictions are hitting seasonal businesses particularly hard. Wages will need to rise to induce domestic workers to step in. Bottom line? Inflation may not be getting a lot of press yet, but it is definitely here and growing.

Noted economist Brian Westbury forecast the potential return of inflation well before the last U.S. presidential election. Here are insights from an October 10, 2016 white paper he helped author: “Just look at housing costs — a non-traded good — which makes up one-third of the CPI. Government statisticians measure this as ‘Rent of Shelter,’ which includes normal rents, hotel costs, and owners’ equivalent rent (the rental value of owner-occupied homes). It’s up a whopping 3.4% in the past year and has accelerated in each of the past six years…

“…Although some (usually Keynesian) analysts are waiting for much higher growth in wages before they fear rising inflation, the fact is that wage growth is already accelerating. Average hourly earnings are up 2.6% in the past year versus a 2.0% gain only two years ago. Moreover, as a paper earlier this year from the San Francisco Fed pointed out, this acceleration is happening in spite of the retirement of relatively high-wage Baby Boomers and the re-entry into the labor force of workers with below-average skills.

“But we don’t think wages cause inflation — money does. Inflation is too much money chasing too few goods. The Fed has held short-term interest rates at artificially low levels for the past several years while it’s expanded its balance sheet to unprecedented levels. Monetary policy has been loose.

“But banks have held most of the Fed’s Quantitative Easing (QE) as excess reserves. Banks have record loans on their books, but they also hold $2.2 trillion in excess reserves. Most people believe QE was, and is, temporary. So banks have been reluctant to lend it out. After all the Fed could withdraw the reserves, unwind QE, and banks would be forced to ‘call’ their loans.

“But as the Fed has postponed the process of reducing its balance sheet, banks have started to expand the M2 money supply. M2 grew roughly 6% annualized between January 2009 and December 2015. But, so far this year, from January to September, M2 has expanded at an 8.6% annualized rate. More money brings more inflation.” China is also guilty of artificial stimulation, often intervening directly in its stock and real estate markets. Chinese stimulation of its housing sector is a big factor in the 30% jump in house prices in Beijing and Shanghai and incredible 70% pop in Shenzen.

Notably, the Chinese also have a history of using metals as stores of value, especially during inflationary periods. Big rallies in copper (up 30%) and zinc (up 40%) were helped along by Chinese stockpiling. Will silver be next? Silver Is Cheap Compared To Gold

Data Source: FutureSource Metal traders monitor the relationship between gold and silver using the “gold/silver ratio.” It measures the amount of silver (in ounces) needed to purchase one ounce of gold.

Gold is 15 times rarer than silver. When silver and gold were considered money, gold would trade at a premium of roughly 16 times that of silver. It currently takes 74.5 ounces of silver to buy one ounce of gold — making it inexpensive compared to its richer cousin. Those who want to place a bet on higher precious metal prices might do well to consider silver first.

Because it is a much more volatile market, silver tends to outperform gold during bull markets and underperform gold during bear markets. This means the gold/silver ratio is usually at its low when silver prices are highest and at its high when silver prices are at their lowest. Using history as a guide, silver should lead the next bull market in metals. The Dollar Bull Market Is History One of the factors that has helped keep a lid on both gold and silver is the strong U.S. dollar.

The U.S. Federal Reserve was the most aggressive of the world’s central banks following the 2008 housing crash. Zero interest rates and three rounds of quantitative easing led the American economy to recover more quickly than Europe. Lower U.S. interest rates led to a weaker dollar and help fuel a faster recovery.

The weak dollar was also a key player in silver’s 2010 moon shot. Silver (and gold) are priced in dollars. When the dollar is weak, more of them are required to purchase the same amount of silver or gold.

Data Source: FutureSource America’s ability to recover more quickly from the 2008 crisis enabled it to raise interest rates sooner than Europe, strengthening the dollar to the point where the American greenback is now one of the strongest major market currencies. Gold and silver have suffered as a result. But things may be changing…

The European recovery appears to be gaining momentum. At the same time, America’s president favors a weaker dollar. Donald Trump’s pronouncement that the dollar is “too strong” was heard by currency traders the world over. A quick look at a U.S. Dollar Index chart shows a dollar that has spent the last 2 ½ years chopping sideways in a wide trading range.

Further cracks in the dollar should be very good for silver. Mix in growing global tensions (including the very real potential of a shooting war with nuclear North Korea), a new American president who hasn’t found his sea legs yet, as well as the inflationary policies of the globe’s two largest economies — and you have all the ingredients to ignite a big move in silver. Exploding solar demand is just the cherry on top. How to Play It RMB Group has come up with a silver option strategy specifically designed to take advantage of a big move in silver in 2018. Click here to get the full report which includes an easy-to-follow explanation of this bullish trade. The RMB Group

222 South Riverside Plaza, Suite 1200, Chicago, IL 60606 Note: The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment.

Editor’s Note: Steve Belmont is a Senior Managing Member and Research Director of the Rutsen Meier Belmont (RMB) Group in Chicago. He is the editor RMB Group flagship commodity option alert service, RMB “Big Move Trade Alerts” which focuses on longer-term LEAP style option plays that are designed to allow RMB Group customers to take substantial positions in markets such as gold, silver, crude oil, currencies, interest rates and stock indexes for “pennies on the dollar.” Steve also writes the RMB Group Managed Account Blog. He has personally traded commodities and commodity options for over 30 years. |

77.6 million ounces of silver were used to fabricate solar panels in 2015, accounting for approximately 7% of total demand. With the solar cell market expanding 20% per year, we expect that number to climb significantly once the final numbers for 2016 are tallied.

77.6 million ounces of silver were used to fabricate solar panels in 2015, accounting for approximately 7% of total demand. With the solar cell market expanding 20% per year, we expect that number to climb significantly once the final numbers for 2016 are tallied.