|

To investors,

Headlines induced fear and uncertainty earlier this year, but market facts tell a very different story. The S&P 500 is up double-digits in the last 12 months and the index has nearly doubled in the last 5 years.

Both the S&P 500 and the Nasdaq are positive on the year as well. So no matter how much people yelled, screamed, and cried over the last few months, investors who were long US stocks have done well.

To put this performance in perspective, Mike Zaccardi writes “The S&P 500 is up 24% from the April 7 low. France is up 18% in the last 25 years.”

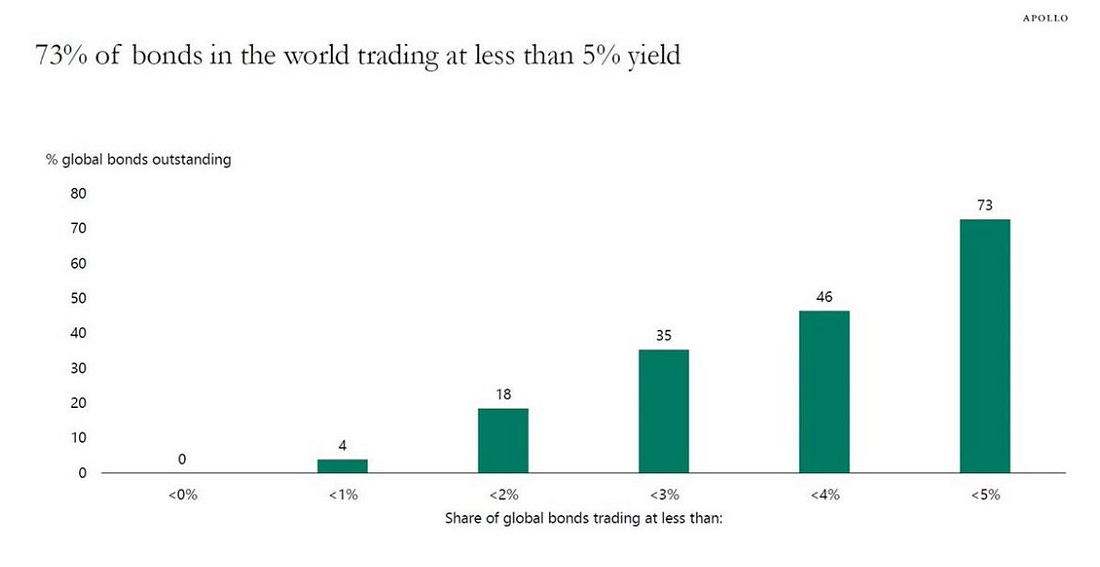

Bond investors have not done well on the other hand. Sam Callahan reminds us that “73% of bonds in the world [are] trading at less than the rate of debasement.”

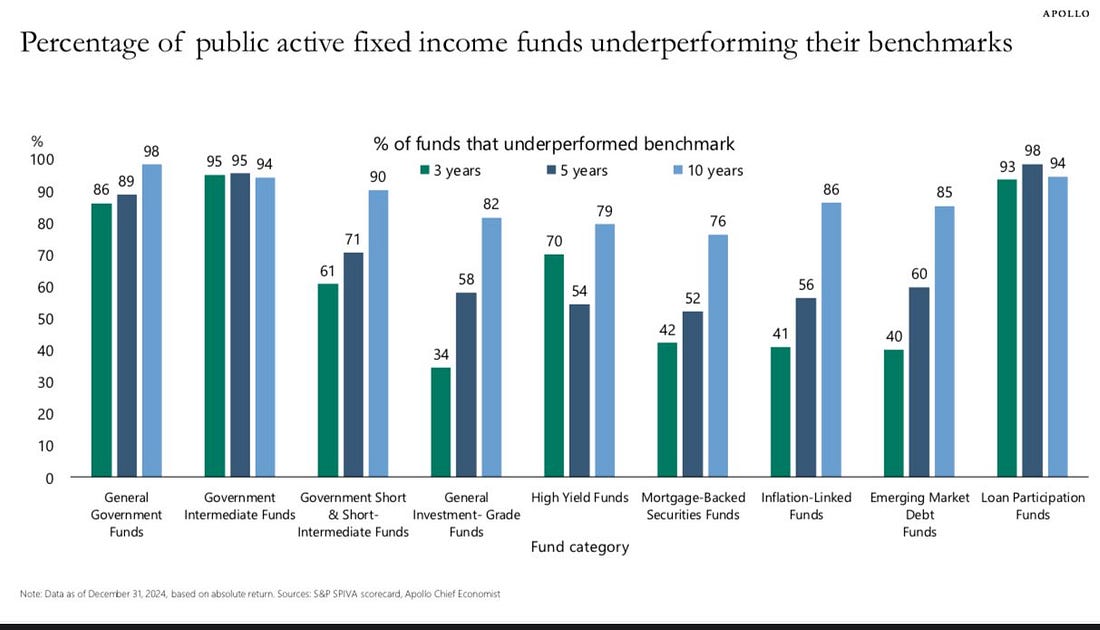

Speaking of underperformance, Pierre Rochard shows a very large percentage of fixed income investors are failing to outperform their benchmarks as well.

And we can’t talk about the debasement of the dollar, or the underperformance of benchmarks, without mentioning bitcoin. We are watching bitcoin’s price closely track the global money supply. As Quinton Francois says, “bitcoin loves money supply.”

So you can see exactly where we are headed — there will be more money printing, a larger national debt, and liquid assets are going much higher. Stocks will appreciate in price. Gold will appreciate in price. And bitcoin will likely be the biggest winner out of every asset.

We are living through a paradigm shift. Young people want bitcoin over almost any other asset. You can see it in the capital flows. You can see it in the online chatter. And you can see it in the financial returns of various assets. Bitcoin is the apex predator of financial markets. It will only stop going up when central banks stop printing money. And I don’t think that will happen any time soon.

Hope you all have a great start to your week. I’ll talk to everyone tomorrow.

- Anthony Pompliano

Founder & CEO, Professional Capital Management

Jordi Visser Breaks Down The Recent Spat Between Elon & Trump, Including What It Means For Bitcoin

Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos

In this conversation, we discuss Elon Musk vs Donald Trump, economists don't believe the inflation data, bitcoin is coiling for a short squeeze, Circle IPO went very well, stablecoins reveal an important truth, how portfolios will change with AI, and stock market all-time high by end of year.

Enjoy!

Podcast Sponsors

Figure – Lowest industry interest rates at 9.9% at 50% LTV! Take out a Bitcoin Backed Loan today and buy more Bitcoin. Check out Figure and their Crypto Backed Loans! Figure Lending LLC dba Figure. Equal Opportunity Lender. NMLS 1717824. Terms and conditions apply. Visit figure.com for more information.

EightSleep - Recently launched The Pod 5, a high-tech mattress cover you can easily and quickly add to your existing bed. Use code Anthony for $350 off your Pod 5 Ultra

Bitizenship - Get EU residency through Portugal’s Golden Visa while maintaining Bitcoin exposure. Book a free strategy call at bitizenship.com/pomp..

Bitwise Asset Management - Crypto specialist asset manager with more than $10 billion client assets and more than 30 crypto solutions across ETFs, index funds, alpha strategies, staking, and more. Learn more at bitwiseinvestments.com

Maple Finance - Maple enables BTC holders to earn native BTC yield. Learn more at Maple.Finance!

Xapo Bank: Fully licensed bank that integrates traditional finance and Bitcoin. Earn up to 3.9% interest in BTC. Spend globally with a debit card that gives 1% cashback in BTC. Borrow up to $1M instantly with Bitcoin-backed loans.

Simple Mining offers a premium white-glove Bitcoin mining service. Want to grow your Bitcoin stack? Visit Simple Mining here.

Gemini - Invest as you spend with the Gemini Credit Card®. Issued by WebBank.

Core - Earn trustless Bitcoin yield. No bridging. No lending. Just HODLing. Begin Staking Your Bitcoin.

BitcoinIRA - Buy, sell, and swap 75+ cryptocurrencies in your retirement account. Pay less taxes. Earn up to $1,000 in rewards.

Polkadotis a scalable, secure, and decentralized blockchain technology aimed at creating Web3. Innovation leader, making it a preferred choice for big names.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.