6. GMR Group (GMRINFRA)

Target: 80 – 102 – 186+

GMR Infra is a long racehorse. It has made a high of Rs.132.35 on Dec ’07. We see this stock price above Rs.186+ in upcoming years. A long position can initiate between the range of Rs.30 – Rs.34.

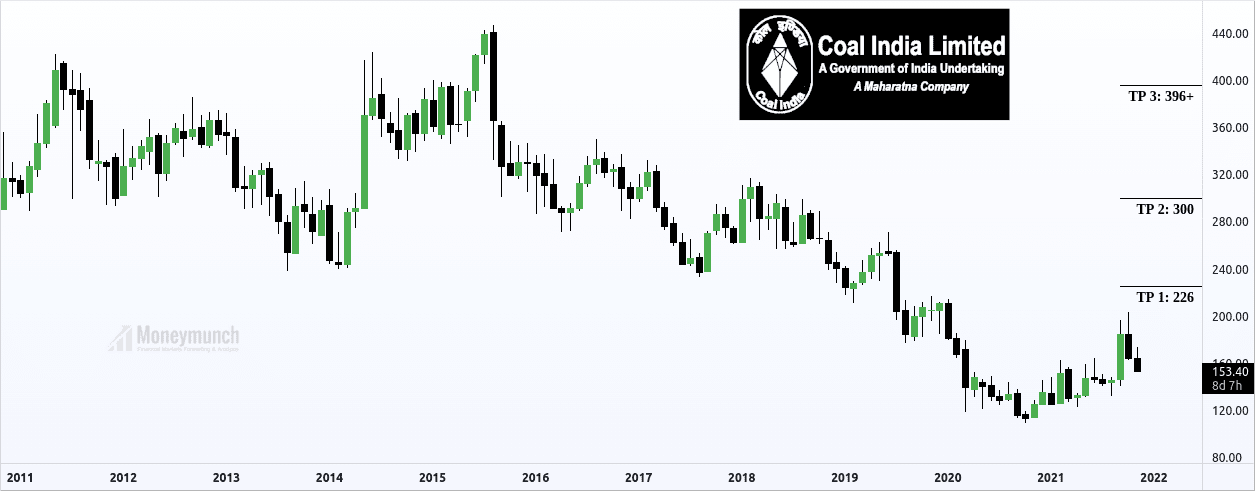

7. Coal India (COALINDIA)

Coal India is a government-owned coal mining and refining corporation. And the largest coal-producing company in the world. We may see the Rs.656 stock price of Coal India in the future.

COVID-19 still exists. This pandemic situation can show the stock price nearby Rs.54 – Rs.56 due to volatility. Who’s planning to invest for the next ten years? You can buy this stock nearby 150 level. And the strong support level is Rs.114.

8. BHEL (Bharat Heavy Electricals Limited)

BHEL has made a high of 390.65 on 01 Nov ’07, and it had made a low of 18.4 during COVID-19 beginning.

According to fundamental research, we may see a retest of the following levels: 42 – 30

Long-term investors can take entry between the range of 60 – 56.

My prediction is BHEL will hit 186 – 300 before 2026. It may take time to break an all-time high and touch the last target of 400 because it’s Indian government-owned engineering and manufacturing enterprise.