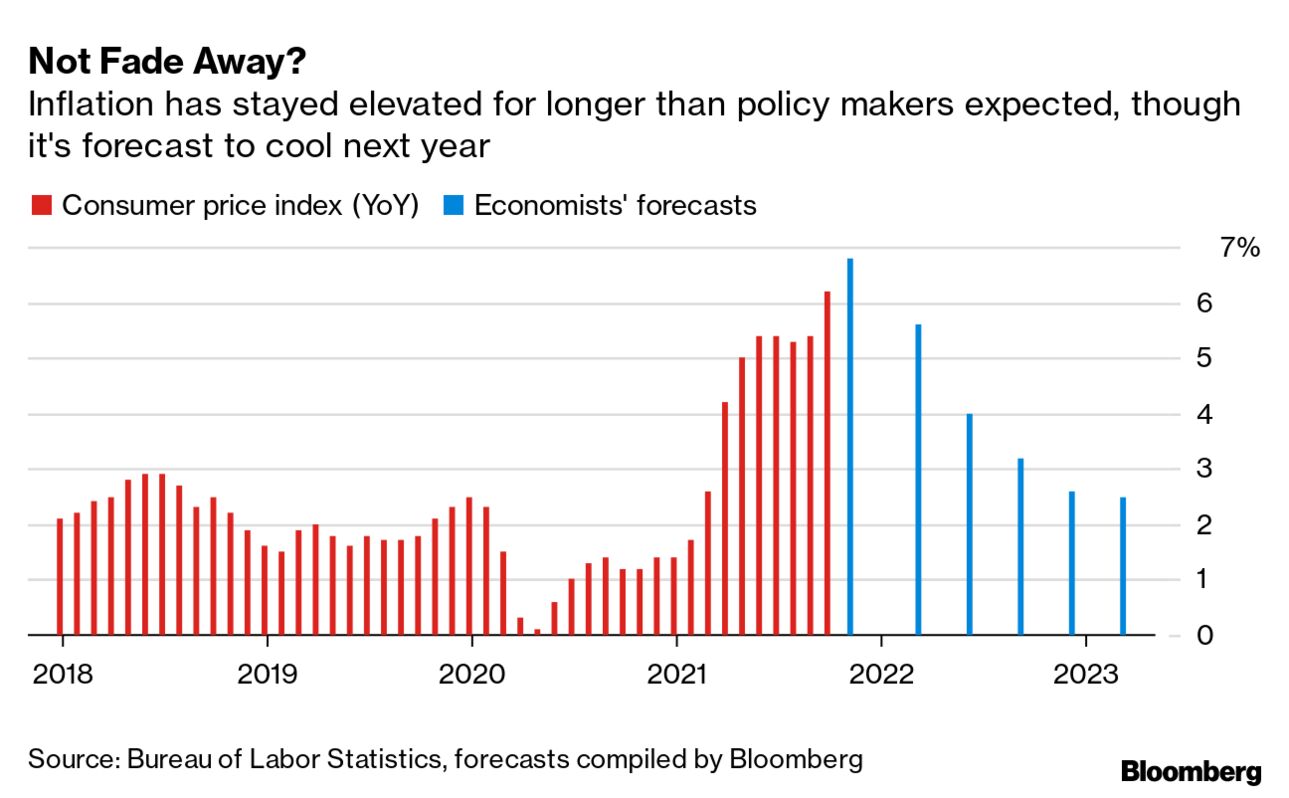

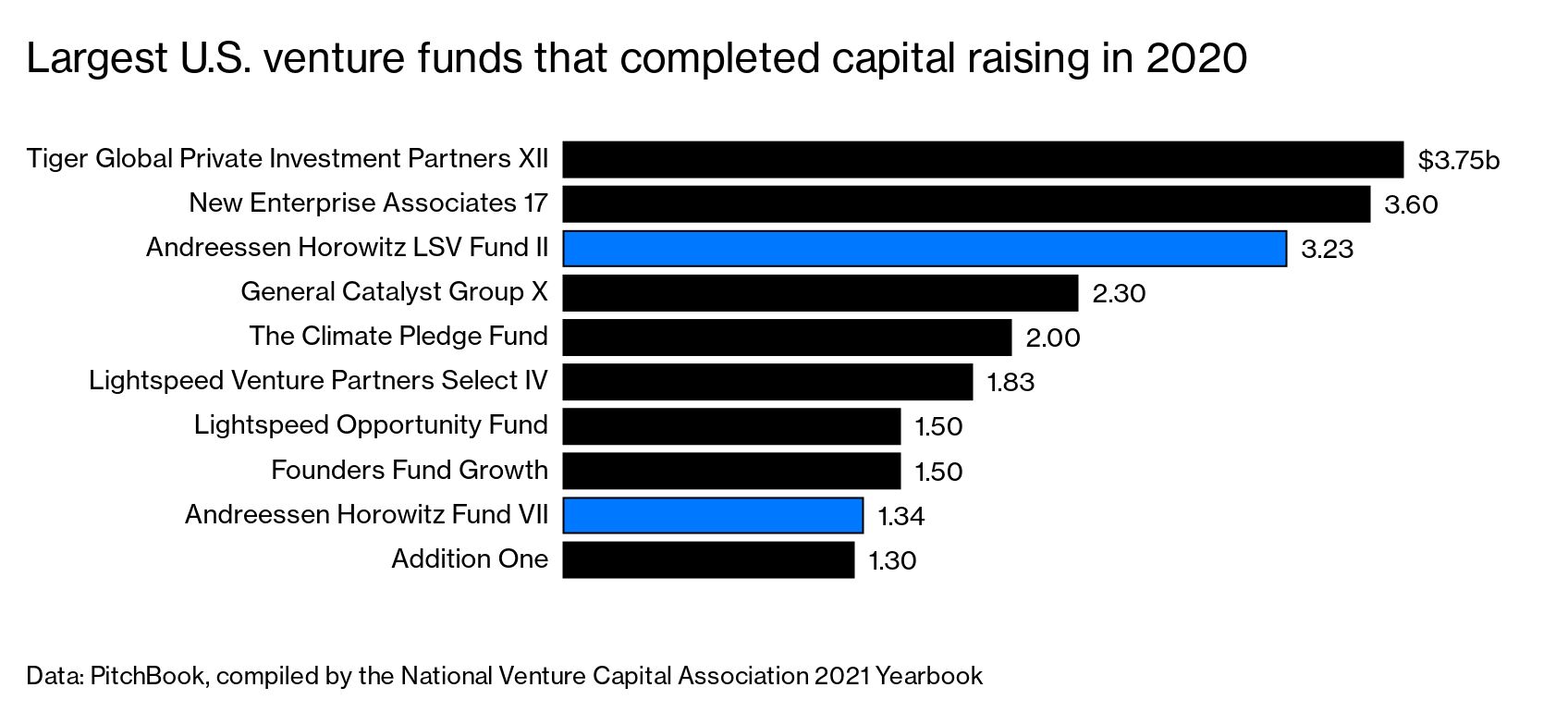

| Too big to fail? A Lehman moment? We’ll see. China Evergrande Group has officially been labeled a defaulter for the first time, the latest chapter in a drama likely to end in massive restructuring for the world’s most indebted developer. Fitch cut Evergrande to “restricted default” over its failure to make coupon payments this week, a move that may trigger cross-defaults on the developer’s $19.2 billion of dollar debt. While Evergrande bondholders face grim prospects, so far there are few signs of financial contagion. That’s partly due to the default having been widely expected—but also because China’s government has been scrambling to cushion the blow. Still, Beijing has made it clear it has no intention of bailing out the property empire, which is $300 billion in debt. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. More research into the omicron variant of the coronavirus is starting to roll in. And as far as getting it is concerned, the news hasn’t been good. The mutation is 4.2 times more transmissible in its early stage than delta, itself leaps ahead of predecessors. In the U.S., predictions of rising infections and hospitalizations as a result of Thanksgiving gatherings were correct, particularly in the Northeast. And there’s more evidence booster shots are becoming a critical defense: South Korea is seeing a surge of infections despite being one of the most vaccinated places in Asia. Here’s the latest on the pandemic. Any optimism that the rise of omicron—assuming its less dangerous-reputation is borne out by further study—means 2022 is looking brighter may be misplaced, Tyler Cowen writes in Bloomberg Opinion. It could still bring enormous disruptions to businesses and schools. The U.S. is poised to enter the third year of Covid-19 with both a booming economy and climbing inflation, the latter fueled largely by the pandemic’s consequences for consumer behavior and workers. President Joe Biden is taking credit for lower gas prices and his Commerce Secretary is predicting prices will moderate as supply and labor crunches ease. While that might come to pass, November inflation data comes out Friday—and it’s not looking good. Here’s your markets wrap. JPMorgan, Citigroup and six other large banks allegedly might have information about billions of dollars looted from Libya by former dictator Moammar Al Qaddafi. Starbucks employees voted for unionization at one of two New York restaurants, potentially establishing a union foothold among the coffee chain’s thousands of corporate-run U.S. locations. Bitcoin declined for the first time in five trading sessions, with losses accelerating after it failed to sustain momentum following last weekend’s flash crash. The largest digital token slipped below the $50,000 level, with losses extending in afternoon trading in New York Ben Horowitz and Marc Andreessen have bought homes in Las Vegas and are cutting down on board memberships. It looks like the founders of Andreessen Horowitz, the prominent venture capital firm, have begun the slow process of stepping back. There were great expectations for 2021. A year ago, vaccines were on the cusp of being delivered, economies were predicted to storm back from the pandemic and a new American leader pledging to fight the climate crisis was about to be sworn in. The thought was maybe—just maybe—the world would emerge from the darkness. That’s not what happened.  The consequences of fossil fuel use became ever-more apparent in 2021. Above, an elderly woman flees her village amid a spreading wildfire on the island of Evia, Greece, on Aug. 8. Photographer: Konstantinos Tsakalidis/Bloomberg Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. See what everyone is talking about. Make sense of the biggest trends affecting your world, every week, straight to your inbox, from Bloomberg Quicktake. |