| Week ending December 1, 2017 |

Oil prices drive small increase in commodity prices

|

Oil leads a narrow rise in commodity markets

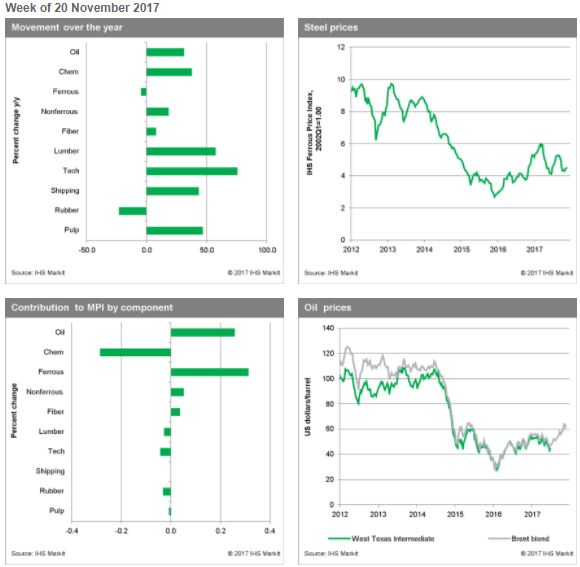

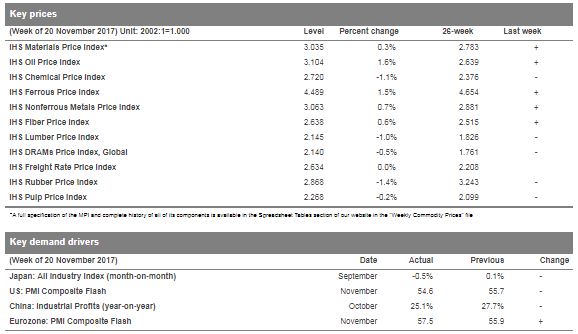

The IHS Materials Price Index (MPI) increased by 0.3% last week, its third consecutive gain. The increase was narrowly based, as only 4 of the 10 subcomponents rose. Oil and ferrous metals were the biggest movers, increasing 1.6% and 1.5%, respectively.

Higher throughput and elevated exports led to a drawdown of 1.9 million barrels in US crude inventories, while a spill from the Keystone Pipeline worried oil market watchers; both items contributed to the rise in oil prices. It is also becoming widely accepted that OPEC will extend production cuts at its meeting this Thursday, 30 November. We expect OPEC and Russian cuts will be extended through the end of 2018, although we also believe they will not be enough to overcome supply increases from non-OPEC producers that are on the horizon.

Other factors also helped support commodity prices last week. Minutes released from the US Federal Reserve’s Federal Open Market Committee (FOMC)’s last meeting in late October contained comments that were more dovish than expected from some officials, contributing to a softening in the dollar and helping push up commodity prices. Despite the market’s slight change in the subjective probability of a third rate hike this year, we have not changed our view—we expect a rate hike in December. Other data releases were relatively unexciting last week. Japan’s all industry index for September declined by 0.5% month on month and growth in industrial profits slowed in China. The Eurozone Purchasing Managers' Index (PMI) Composite Flash release offered the one bit of exciting news, coming in at 57.5, a strong reading 1.6 points higher than in October.

Looking into 2018, we continue to see commodity prices range-bound—supported by a continuing global expansion, but held in check by slower growth in China, tightening credit markets, and flat oil prices.

|

|

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

Get the Materials Price Index delivered to your in-box weekly.

Subscribe here.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction costs rose again in October

|

Construction costs rose again in October, according to IHS Markit and the Procurement Executives Group (PEG). |

The current headline IHS Markit PEG Engineering and Construction Cost Index registered 61.8, up from 58.4 in September.

All downstream materials, ranging from transformers to electrical equipment, showed a higher index figure relative to last month. This is indicative of price increases in raw materials filtering to downstream materials. "Electrical equipment prices will experience modest escalation over the next two years, driven by double-digit increases in the price of copper,” said John Bauman, principal economist - pricing and purchasing, IHS Markit. “However, prices for two other important input categories – fabricated metals and plastics – are expected to weaken and provide some relief.”

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|