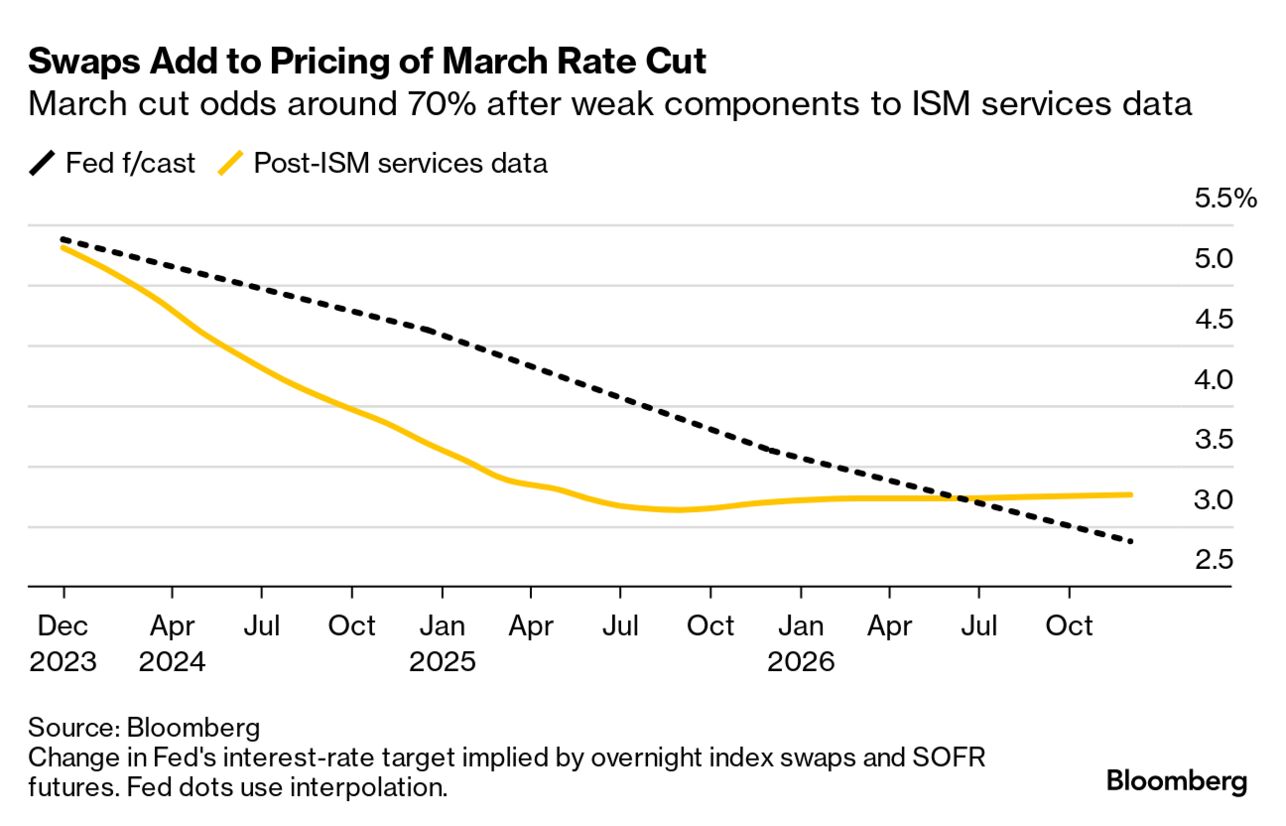

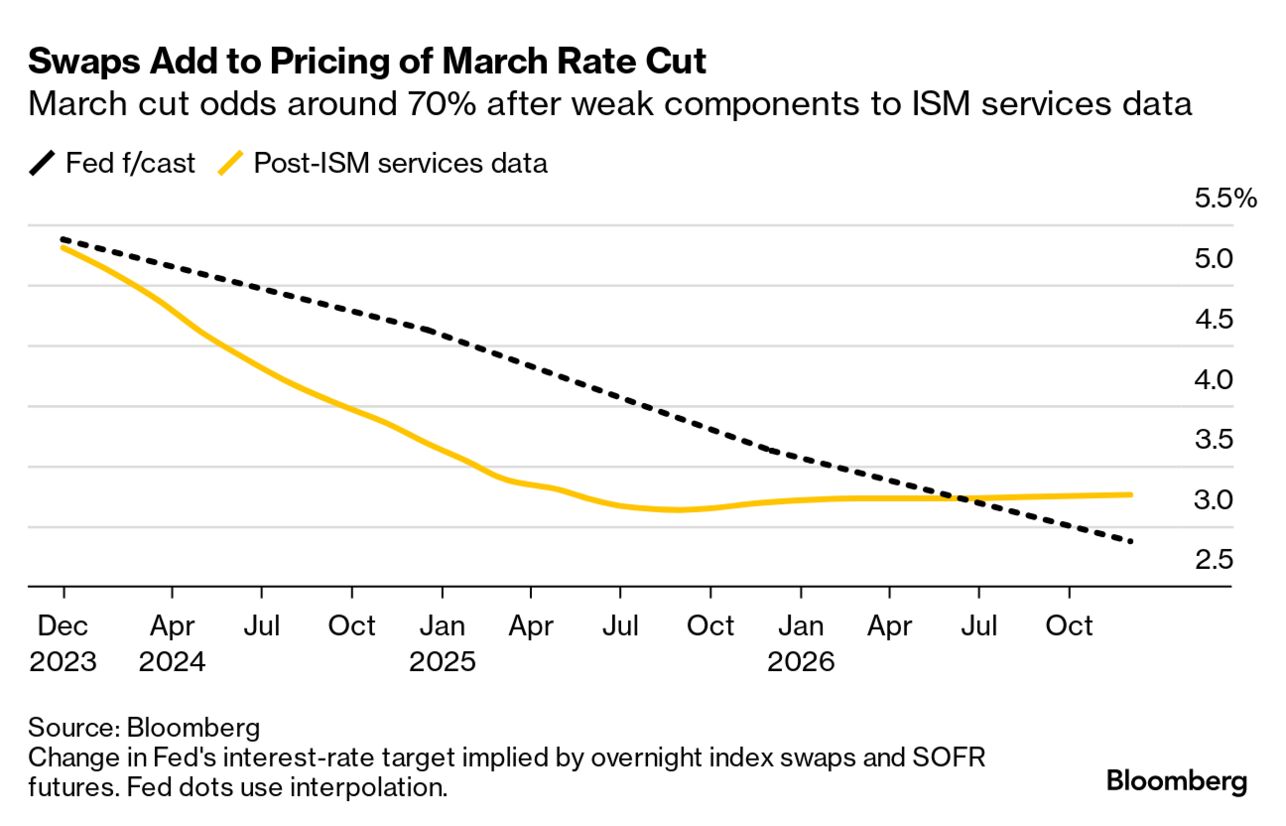

| US Treasury Secretary Janet Yellen made an unusual declaration after Friday’s positive job numbers. “What we’re seeing now I think we can describe as a soft landing,” she said after December’s report showed a gain of 216,000 nonfarm jobs with wage gains exceeding expectations. The comment was a departure for the circumspect former Federal Reserve chair, who had earlier said she saw only “a path” for a soft landing. (As a reminder, a soft landing is—loosely—when inflation recedes without an attendant recession.) Many investors took the good jobs news as a moment to ratchet back bets the Fed will start cutting interest rates as early as March. “May is more likely,” former New York Fed President Bill Dudley said, while others have indicated it may take even longer. Bond traders, however, appear resolute about more imminent cuts.  Still, not everyone sees the jobs data as all rainbows and unicorns. Bloomberg Economics said the news “is permeated with evidence of a fast-cooling labor market,” including drops in labor participation and household employment. Add to that Russia’s war on Ukraine, the Middle East conflict and related attacks on shipping in the Red Sea, and you get significant global insecurity. A disruptive US government shutdown isn’t out of the question, either. And of course in this presidential election year, it’s not just the numbers but perception. Will Americans after years of pandemic- and war-induced inflation stick with President Joe Biden or turn to Republicans? Despite a regular drumbeat of near-record employment and positive economic news, the White House has so far failed to glean any significant political benefit. Biden economic aide Jared Bernstein contends there’s “some promising evidence that folks are beginning to feel it,” but whether he’s right or engaged in wishful thinking is too early to tell. In a speech on Friday near Valley Forge, Pennsylvania, marking the third anniversary of the Jan. 6 attack on the US Capitol, Biden warned that the choice in November could be between democracy and dictatorship. US Secretary of State Antony Blinken is in the Middle East as violence tied to the Israel-Hamas war widens further. While Islamic State claimed responsibility for bombings in Iran that killed almost 100 people—the deadliest since the Islamic Republic was founded—it hasn’t lessened fears of a regional war. Iran faces blame for attacks on Red Sea shipping by its proxy, the Houthi rebel group in Yemen, and the risk of a full-scale war between Israel and Iran-proxy Hezbollah grew. Maersk again suspended transits in the Red Sea as shipping prices soared. And amid back-and-forth attacks since the war began, Hamas said Israel assassinated one of its senior leaders in Lebanon. “We don’t expect every conversation on this trip to be easy,” a State Department spokesman said of Blinken’s visit to eight countries plus the West Bank.  Antony Blinken Photographer: Nathan Howard/Bloomberg Claudine Gay resigned as the president of Harvard, a possible moment of reckoning for America’s elite schools over academic freedom, free speech, diversity and governance. The controversy began amid a donor revolt, led by Bill Ackman, over Gay’s reaction to pro-Palestinian protests on campus and her testimony before a Congressional committee. Later, allegations of plagiarism arose. The episode, Allison Schrager says in Bloomberg Opinion, shows that top universities must return to their original mission: producing academic excellence, not just signaling it. “An unaccountable oligopoly is especially ill-suited to allocating prestige and wealth,” she writes.

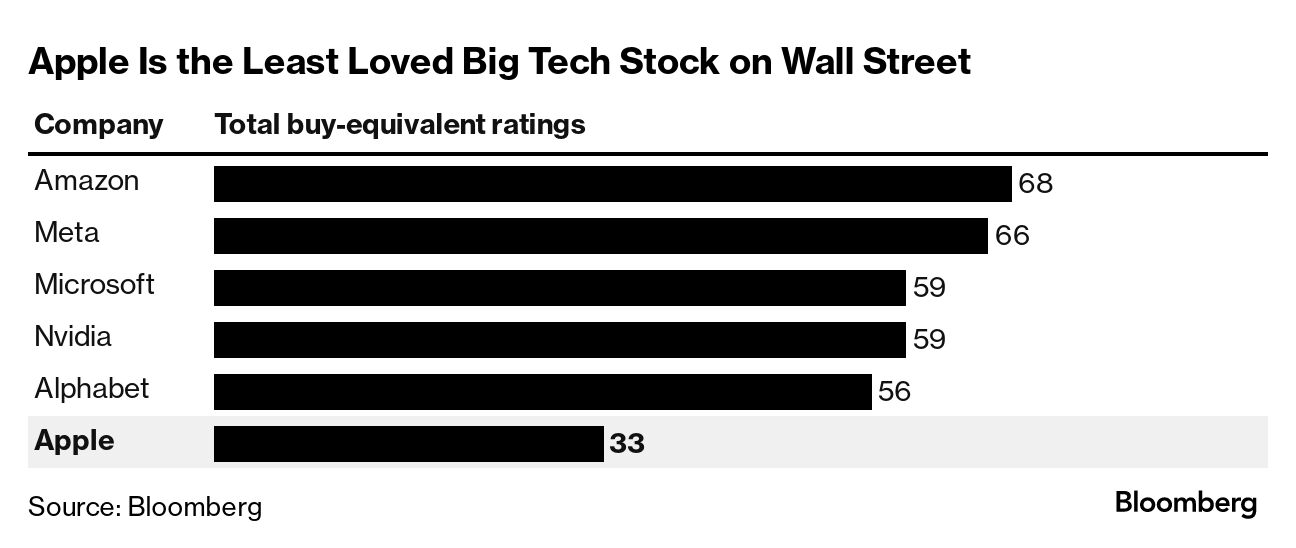

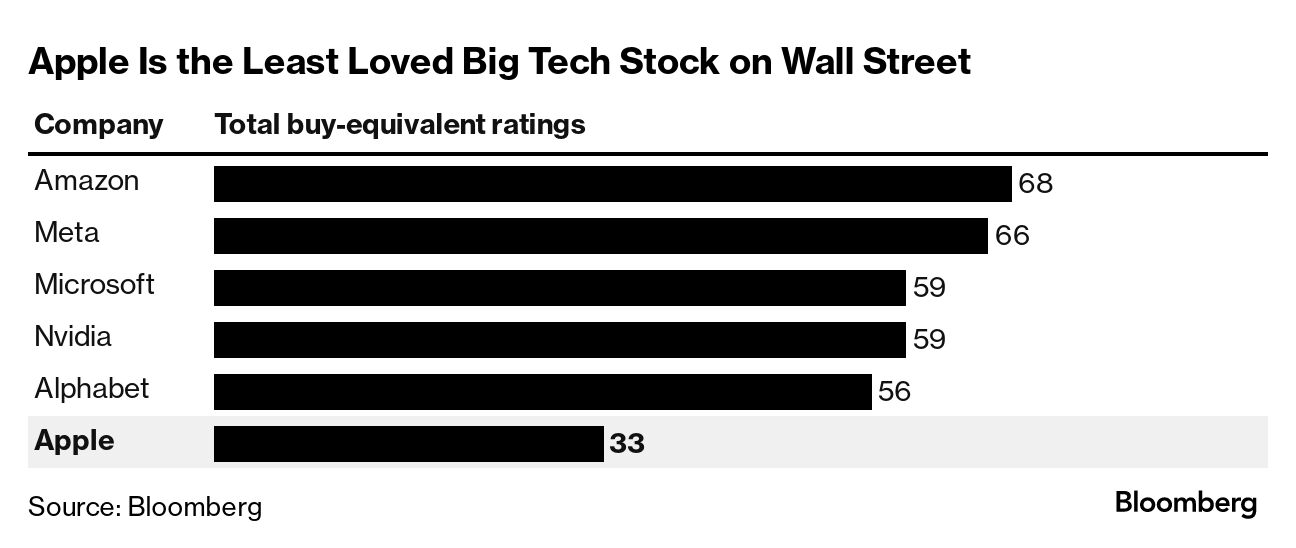

Apple stock—not an investor favorite at the moment—was downgraded for a second time in a week over worries that a weak macro-environment in China will hurt iPhone sales. The company led a rout in tech stocks, a slump that erased $383 billion in market value among companies that lifted the broader market last year. Tesla, even while beating forecasts for vehicle deliveries in the fourth quarter, was overtaken by Chinese maker BYD as the world’s new No. 1 in EV sales (read more below). The shift comes as many buyers are having second thoughts about fully electric vehicles.  What does Xi Jinping mean exactly when he talks about “high-quality development” as the future of China’s economy? No one seems to be sure, but he’s using the slogan more these days—a critical time for his nation’s changing economy. Chinese shadow banking giant Zhongzhi Enterprise Group just filed for bankruptcy, cementing the rapid downfall of a firm that oversaw more than $140 billion at its peak before succumbing to the nation’s property crisis. China is also launching an anti-dumping investigation into liquor products like brandy from the European Union, in a modest tit-for-tat over a probe into China’s EV subsidies. Where to go in what looks like a record year for travel? Bloomberg recommends the 24 most exciting places of 2024, from Boston to Busan. For help getting there, here’s a ranking of on-time airlines: the best remade itself after filing for bankruptcy in 2020. And here’s how billionaires are pricing out mere millionaires on an exclusive island off Miami.  Coral Lagoon—also known as the Dragonara Cave—in Malta Source: Malta Tourism Authority “The biggest car brand you’ve never heard of.” Those are the words China’s top carmaker is using to promote itself as it looks to expand across the globe. Having become China’s best-selling auto brand at home, BYD Co. (which stands for Build Your Dreams) has now surpassed Tesla to be the world’s biggest maker of electric vehicles. In the mini-documentary How BYD Took Tesla’s Crown, Bloomberg Originals explores how a company that started as a battery manufacturer transformed itself into the global king of EVs.  BYD electric cars waiting to be loaded in Suzhou, China Photographer: AFP Get Bloomberg’s Evening Briefing: If you were forwarded this newsletter, sign up here to get it every Saturday, along with Bloomberg’s Evening Briefing, our flagship daily report on the biggest global news. Bloomberg House at Davos: Meaningful change happens when the right people come together in the right place. Bloomberg House in Davos is where leaders in business, media and policymaking connect, exploring solutions to the world’s most critical challenges. Make our house your home base at the World Economic Forum, Jan. 15-18. Find us at Promenade 115, a five minute walk from the Congress Centre. Register to join.

|