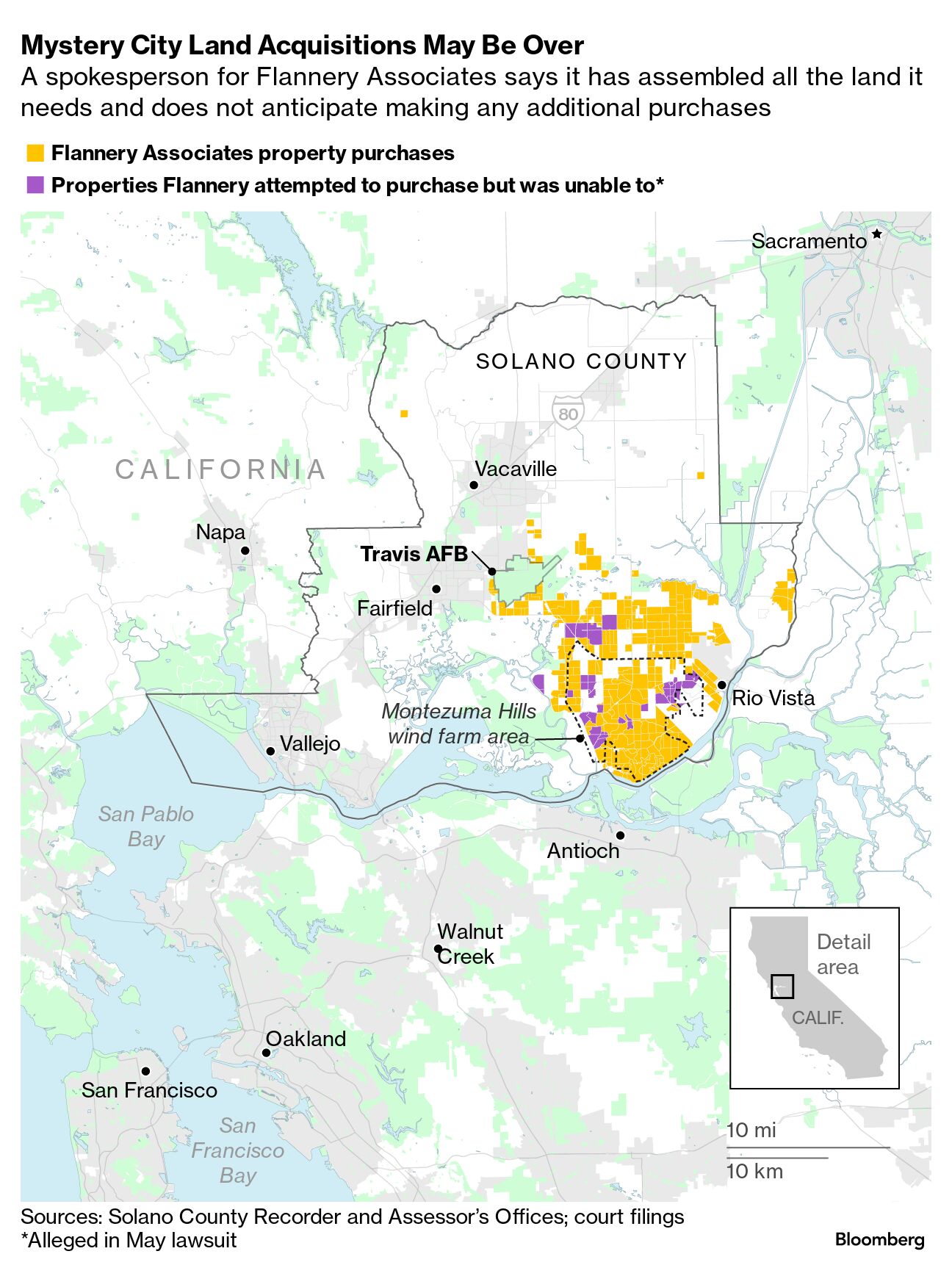

| Can Jerome Powell declare victory? Maybe not just yet, but a cooling US job market gives the Federal Reserve Chair and his colleagues room to keep interest rates on hold in December and reinforces market views that the central bank is done with rate hikes—all as it zeroes in on a soft landing. Nonfarm payrolls increased 150,000 last month, less than expected, following a downward-revised 297,000 advance in September, a Bureau of Labor Statistics report showed Friday. The unemployment rate climbed to a still-low 3.9%, and monthly wage growth slowed. “Put a fork in it. They are done,” said Jay Bryson, Wells Fargo’s chief economist. “This is very good news for the Fed.” —David E. Rovella Three bad months and one good week. That’s what we can say about markets today. Having come out of a gruesome three-month slide, there seemingly was nowhere to go but up. Stocks rose and bond yields fell on Friday thanks to that cooling job market data. All across Wall Street, the superlatives piled up, with the S&P 500 rising about 1% and notching its best week in 2023. The market’s “fear gauge” saw its biggest five-day plunge in 21 months. Treasuries climbed across the curve, with two-year yields dropping 16 basis points to 4.83%. The dollar slid the most since July. Oil sank below $81 a barrel. The US government laid out a pathway for placing firms other than banks under strict Fed oversight, a major regulatory overhaul squarely aimed at hedge funds and investment companies. After months of back-and-forth, Washington’s top financial officials released a new framework for designating financial firms as systemically important. That too-big-to-fail tag, which brings significant compliance costs and regulatory headaches, has mostly been applied to large Wall Street banks since its introduction more than a decade ago. You know, back when Wall Street almost wrecked the global financial system. How to deal with America’s intractable housing crisis? Well, in the nation’s most expensive metro area for housing, city streets are getting tiny homes made out of repurposed shipping containers. The new quick-build dwellings in San Jose, California, cover 80 square feet—enough for a bed, desk, mini fridge and coveted private bathroom. They also offer a chance for stability to people such as Steven Dotson, who often lived on the street during a four-decade struggle with alcoholism. “When I was homeless, people just didn’t think I was real, they wouldn’t even acknowledge me,” said Dotson, 55. “This place, it’s a blessing. It gives me hope and motivation to do something different with my life.”  Quick-build modular housing units sourced from shipping containers in San Jose, California Photographer: Michaela Vatcheva/Bloomberg Justice has been served—and swiftly, too, writes Lionel Laurent in Bloomberg Opinion. A jury in Manhattan federal court wasted no time in finding fallen crypto mogul Sam Bankman-Fried guilty of seven counts of fraud and conspiracy, deliberating for only five hours. That’s markedly less time than it took for jurors to puzzle over the fate of fraudster Elizabeth Holmes of Theranos infamy or Raj Rajaratnam’s insider trading at hedge fund Galleon. Laurent writes that, while Bankman-Fried’s crimes are certainly crypto’s biggest case of fraud, they undoubtedly won’t be the last. The French village of Chamonix has been the thriving center of European mountaineering for more than three centuries. But the climate crisis is upending the once-reliable seasons that underpin the region’s important tourism industry. The Alps have warmed by about 0.5°C each decade since the 1980s, according to the Research Centre for Alpine Ecosystems. That’s made some of the most used routes more dangerous—and at times unclimbable—as rockfall increases and glaciers melt.  Climbers pass over the Dôme du Goûter shoulder of Mont Blanc just before sunrise. In the distance are Mont Blanc du Tacul and Mont Maudit, part of the classic “Three Monts Route” that leads to the summit of Mont Blanc. Photographer: Ben Tibbetts Colombia is accelerating its effort to recover as much as $20 billion in gold, silver and gems from a three-century-old shipwreck, even as US treasure hunters sue for half the value. President Gustavo Petro told officials to set up a public-private partnership, or do a deal with a private firm, to get the San Jose galleon off the Caribbean Sea floor as soon as possible, according to the minister of culture. It’s cricket’s turn. Saudi Arabia has expressed interest in buying a multibillion-dollar stake in the Indian Premier League, international cricket’s most lucrative event, following a string of investments that have upended professional sports including football and golf.  A billboard featuring players of Mumbai Indians team of the IPL tournament in Mumbai Photographer: Indranil Mukherjee/AFP/Getty Images A Silicon Valley group backed by billionaires said it’s acquired all the land it needs to build a utopian city in northern California after quietly buying more properties in the past month. Flannery Associates, the company behind the California Forever project, acquired at least seven more land parcels in Solano County totaling about 814 acres. The company now owns more than 53,000 acres in the area where it plans to create a walkable, green community it says will generate thousands of jobs. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg New Economy Forum: The sixth annual Bloomberg New Economy Forum returns to Singapore Nov. 8-10 as the world’s most influential leaders gather to address the critical issues facing the global economy. This year’s theme, “Embracing Instability,” focuses on opportunities to better understand underlying economic issues such as persistent inflation, geopolitical tensions, the rise of artificial intelligence and the precarious state of the world’s climate. Watch the livestream on BloombergNewEconomy.com. |