Gold Takes A Break Gold dropped after today’s upbeat jobs report, but it won’t be long before it’s back on track.

Plus: A fascinating new video on the modern energy revolution and the commodities that will benefit the most. Dear John, I’m not worried about gold’s drop today, and neither should you be. The nonfarm payrolls report released this morning came in at 209,000 jobs created in July, beating expectations of 175,000.

That was a nice beat, and on the news gold fell about $10 and the Dollar Index jumped about 0.78%. Those are fairly serious moves, but again...I’m not concerned.

Both gold and the dollar have been making big moves lately — gold to the upside and the dollar to the downside. Gold was overbought and the greenback was oversold, so a break in the trend is both expected and welcomed.

The pause in gold may take a few days to get past, however. The positive jobs number means that the Fed is likely on track for another rate hike this fall or winter, and should also begin rolling off its balance sheet (quantitative tightening) in September.

It will take a little while for traders to accept this reality in the gold market.

But, as I’ve been saying in Gold Newsletter, the real story behind gold these days is that it seems to always find a reason to rise.

When we get hot inflation readings, they’re interpreted as a reason to buy gold. When indications of lower inflation come around, traders find a way to justify buying gold as a result.

The same goes for Fed policy. Dovish statements lead to immediate rallies in gold, of course. But even hawkish indications are, after some time, transformed into some rationale for buying the metal.

This is the hallmark of a bull market — when investors look for reasons to buy instead of excuses to sell. |

Big Profits Are Already Rolling In Gold and silver have been rising in a stair-step fashion this year, seemingly always in search of a reason to rise...and always managing to find one.

If we’re getting this kind of steady performance in the middle of the summer doldrums, when few are paying attention, imagine what we’re going to see in the typically more-bullish fall season.

What’s really interesting about the recent performance in the metals is that many junior mining stocks are already soaring.

Granted, many of these are “drill-hole speculations” that are more dependent upon their individual success with the drill bit than the state of the gold market.

Regardless, some of these stocks are exploding higher.

You might remember that I told you a couple of weeks ago that I had pinpointed five companies drilling at that moment, and each of them was poised to make a big discovery. I revealed all of these companies in the July issue of Gold Newsletter.

Well, so far one of those companies — GT Gold (GTT.V) — hit it big, and has more than tripled from our entry price in Gold Newsletter.

I think the rest of my picks could follow suit, as well as exciting new recommendations that I’m making in Gold Newsletter now.

The fact is, I believe we’ve entered the next phase of the gold market, wherein many of the junior stocks are going to provide enormous gains as they make new discoveries.

If you want to get in on the fun, you should subscribe to Gold Newsletter now.

In the meantime, I have another exciting opportunity to offer you, at no charge... The Impact Of The Modern Energy Pivot:

Dennis Gartman And Gianni Kovacevic The world is changing around us. Fast.

You don’t need me to tell you that. We can all see the amazing transformations around us, particularly in energy, as fracking has made the U.S. the world’s most dynamic energy producer...yet Tesla and others are rapidly electrifying our freeways.

And that’s just a snapshot of the amazing transformation going on around us.

This, of course, begs the question: How do we make money from these monumental changes?

To get some valuable insights on the big changes in energy and their effect on commodities, I suggest you view a fascinating presentation by famed trader Dennis Gartman and commodities expert Gianni Kovacevic.

I met with Gianni last week in Vancouver, and complimented him on this great “mini-seminar” with Dennis. In fact, I asked him if I could share the video recording of this exclusive, invitation-only event with my Golden Opportunities readers.

He graciously consented, and you can view it here.

I urge you to take a few minutes to view this presentation — it will give you a new, deeper understanding of what the future holds...and how you can profit from it. All the best,

Brien Lundin

Editor, Gold Newsletter

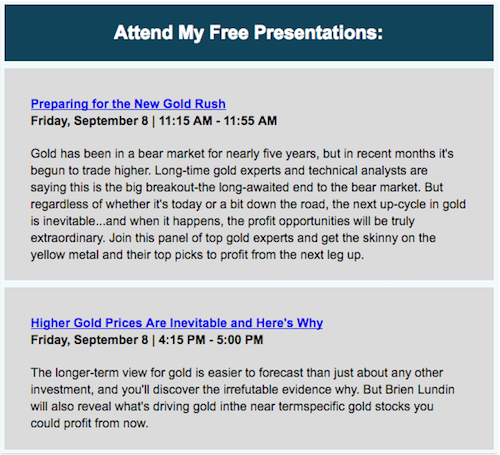

CEO, the New Orleans Investment Conference P.S. As you can see from the ad above, I’m a featured speaker at the upcoming Toronto MoneyShow - click here for more details. I hope you can attend, as I’ll feature my latest views on the gold market, as well as some of my recent top picks.

If you’re able to attend, please take the time to tell me hello! |