Although it’s bounced back today after Janet Yellen’s speech, gold had lost about $25 at one point over the last two trading sessions. That made a bunch of gold bugs nervous.

But they shouldn’t worry: The future is bright for gold, precisely because the most important factor for gold will remain in place for years to come.

Inflation is back. And the Fed will be powerless to stop it.

Consider the latest Consumer Price Index report. Released on February 15th, it featured a big upside surprise with a 0.6% rise in the CPI. That precisely doubled the expectation of a 0.3% gain, and reflected a 2.5% annual rise in headline inflation.

The core rate, stripping out food and energy price gains, came in at a still-hot annual rate of 2.3% that similarly beat the consensus.

Then came the interesting part: The data was initially interpreted as bearish for gold, and the metal sold off.

Now, it might seem that indications of rising inflation would be bullish for gold. But not for the majority of today’s traders, who are obsessed with interpreting the tea leaves of Fed policy thinking.

Thus, the indications of higher inflation bolstered the expectations of the rate hike hawks for a move in March, which prompted traders to dump gold.

That sell-off was quickly reversed, however, as other news came in and gold resumed its upward bias.

But still, it was interesting to see investors returning to their Fed-watching ways. Since the presidential election, and because a December rate hike had already been baked into the cake, there had been little speculation or concern over any Fed action.

It was a welcome respite that’s apparently over. Everyone’s watching the Fed again, and this august group of lever-pulling economists are taking advantage of it.

Over the past week, in what has to have been an orchestrated performance, a veritable parade of Fed presidents have one after another proclaimed that the time is ripe for another rate hike.

The march of unofficial spokesmen is peaking today with no less than five Fed officials speaking, capped off by Fed chair Janet Yellen herself, who’s beginning a speech in Chicago as I write this.

The message they’re delivering: Unless something very drastic and unexpected happens, they’ll raise rates another quarter-point at their upcoming March 15 meeting.

The market is getting the message. Expectations for a March rate hike have soared from around 20% to nearly 80% in just a couple of days, and stocks have turned downward since the “Dow Pow” 300-point leap on Wednesday.

Gold is also in the process of adjusting to this new reality, as evidenced by the $25 slide.

But gold bulls should take heart in the fact that the Fed will remain typically timid, afraid to throttle the U.S. economy even in the face of sharply rising inflation.

And that means a markedly bullish environment for gold.

Real Rates

In The Red

You see, you can look at every indicator out there until you’re bleary-eyed, but all you have to do is focus on one if you really want to know whether the environment is positive or negative for gold.

And that’s real interest rates.

Because of gold’s holding cost (yes, a throw-back to the old days when most people invested in physical gold), low interest rates are bullish for gold. If you can’t earn much on your money in interest, the relative cost of owning gold is less.

That said, negative interest rates are like rocket fuel for gold prices.

That’s because under negative rates you’re losing money more quickly than you can make it by having it sit in a bank. So an investor is essentially being paid to get their money out of the bank and put it into gold.

Add in the fact that the gold price is usually appreciating in such a scenario, and you have a very powerful argument for investing in the metal.

Thus, it gladdens our gold bug hearts to realize that negative interest rates are not only still in effect, but should be for years to come.

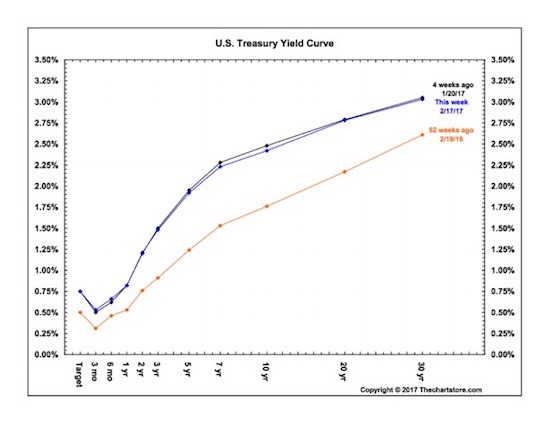

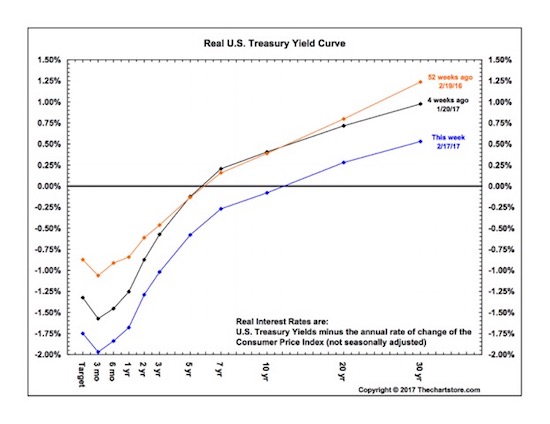

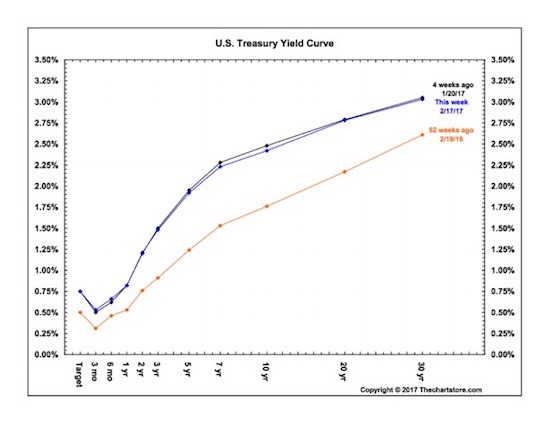

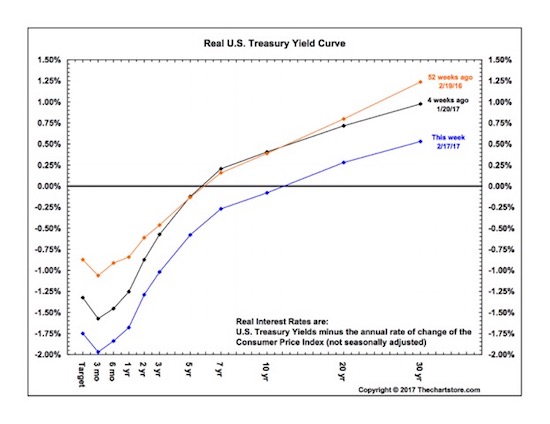

Consider the accompanying charts of the nominal U.S. Treasury Yield Curve and the Real U.S. Yield Curve (both courtesy of TheChartStore.com).

As you can see, nominal Treasury yields have been rising, and are significantly higher today than 52 weeks ago.

Despite these rising yields, however, real Treasury yields — after subtracting the rate of CPI inflation — are mostly negative, and significantly lower than they were a month and a year ago.

So negative yields are only growing more negative, even as nominal rates continue to rise.

This is the effect of rising inflation, and supports my contention that the Fed will remain well behind the inflationary curve for years to come. They simply can’t afford the risk of raising rates more quickly than inflation is rising.

I’m not the only one who thinks so. None other then the St. Louis Fed recently released a paper projecting negative real yields through 2019, and also arguing for negative yields as monetary policy.

This is a tremendous tail-wind for gold and silver. And over the long term it is a factor that will surmount any bearish factor.

So take heart, gold bugs. Despite the recent correction, the future looks bright for the yellow metal.

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

P.S. The recent sell-off in gold created a remarkable buying opportunity that you absolutely need to take advantage of.

The best way to do that is to subscribe to Gold Newsletter, the world’s leading authority on precious metals and mining stocks for over 45 years.

To convince you to act right now, while the time is ripe, I’m going to give you a chance to subscribe at half price for the next 24 hours.

Why the hurry? Because our March issue includes a hot new stock recommendation — the next venture by a talented management group that has never failed to provide our readers with returns measured in hundreds of percent.

You can get all the details…plus ongoing coverage of the metals and mining share market…by subscribing to Gold Newsletter through this limited half-price offer now.

CLICK HERE

Within The Next 24 Hours

To Subscribe To Gold Newsletter

At Half Price