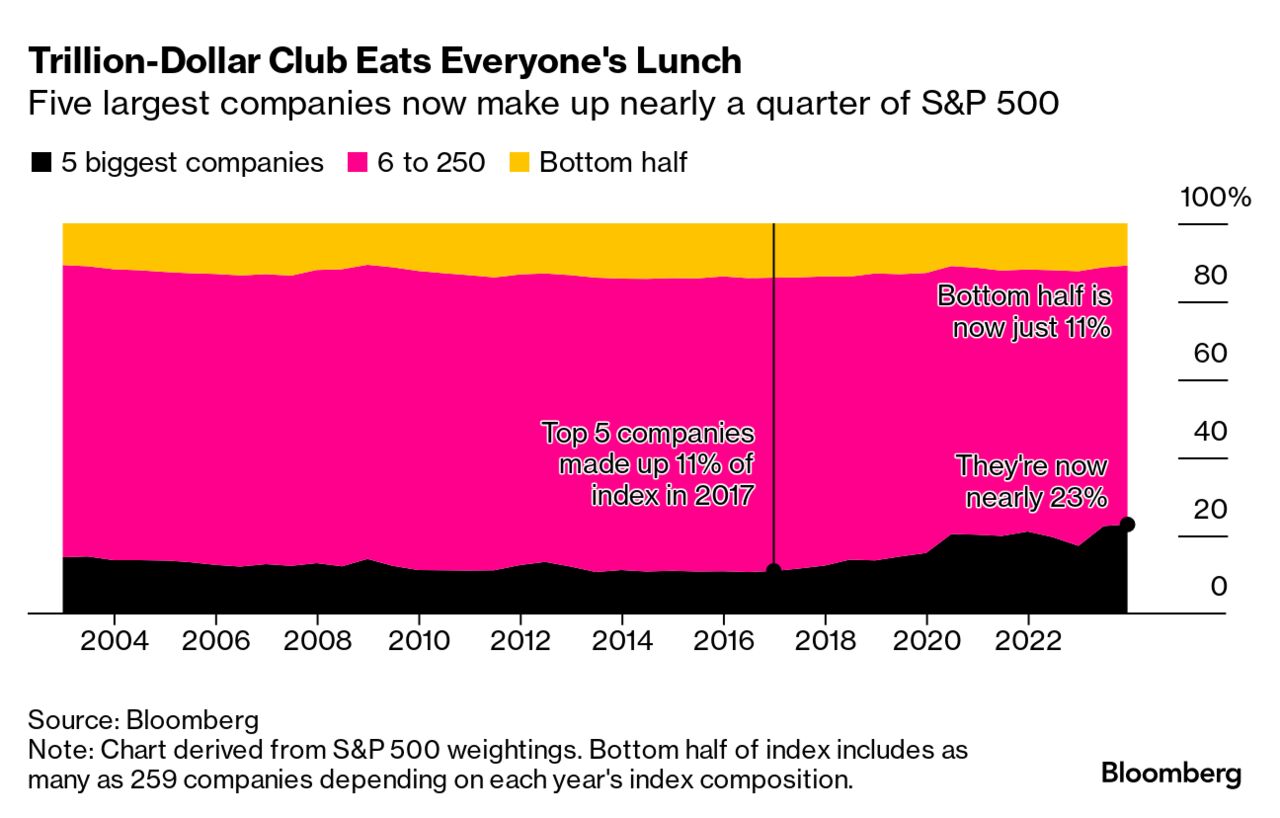

| As the gulf between America’s five largest companies and everyone else continues to widen, gyrations among the rest of the top 50 in the S&P 500 are at a 10-year high. The 50 most valuable companies in the benchmark, which now make up about 56% of its total weight, moved up or down on average nine places this year, tied for the most since at least 2013 and almost double in 2019. And that volatility comes even as the median valuation gap between each company in the top 50 has more than doubled to $7 billion since 2013. This state of affairs suggests that as the S&P 500’s top-heavy skew worsens, there’s increasing competition for investor funds in the rest of the index. Among the companies that joined the top 50 this year are several that seized on opportunities created by the pandemic. Here are some of the stocks that were the biggest movers of 2023. —David E. Rovella US equities jumped ahead of Friday data that’s expected to show the Federal Reserve’s preferred inflation metric is close to its target. The S&P 500, up 1.0% Thursday, is on the precipice of an eight-week winning streak—its longest in more than five years. The Nasdaq 100 index rose 1.2% after Wednesday’s bout of selling had knocked it off record highs. Here’s your markets wrap. Apple has stopped selling the Apple Watch Series 9 and Ultra 2 in the US on its online store, days ahead of a ban tied to a patent dispute. The gadget maker previously said it would end sales at its about 270 physical retail stores in the US on Dec. 24. The ban was imposed by the US International Trade Commission, which ruled that Apple violated two health-technology patents related to blood oxygen sensing held by Irvine, California-based Masimo Corp. The watch disruption is the latest bad news for Apple, whose sales have dropped for four straight quarters—the longest such streak in two decades. Nike said it’s looking for as much as $2 billion in cost savings by firing workers and simplifying its product assortment amid a weaker sales outlook. The sportswear and sneaker giant said it will incur restructuring charges of $400 million to $450 million in the current quarter, “primarily associated with employee severance costs.” Nike sales in the key Greater China region have recently come in lower than expected.  People walk past a Nike store store in Beijing. Investor concern about China are a key focus for the sportswear company amid fears of a pullback in consumer spending there. Photographer: Andrea Verdelli/Getty Images AsiaPac Angola announced it’s leaving OPEC after 16 years of membership amid a dispute over oil production quotas. The country had rejected a reduced output limit imposed by the leaders of the cartel to reflect the country’s dwindling capacity. Angola’s exit will shrink the Organization of Petroleum Exporting Countries to 12 nations at a time when it’s struggling to shore up prices, which have lost almost 20% in the past three months. Led by Saudi Arabia, the group and its allies have cut output to offset booming US production, with only partial success. Hungarian Prime Minister Viktor Orban, who has angered NATO and the European Union by seeking to block military aid to Ukraine, questioned whether Russia’s war—in which the Kremlin has killed tens of thousands of people and been accused of widespread atrocities—should be called a war. “This is a military operation,” said Orban, who has warm relations with Vladimir Putin, apparently adopting his terminology. Meanwhile in the US, where Republicans are demanding immigration and asylum restrictions as their price for Ukraine aid, President Joe Biden is reportedly eyeing Russia’s own cash as a substitute.  Viktor Orban, left, and Vladimir Putin during the judo world championships in Budapest, Hungary, in 2017. Photographer: Akos Stiller/Bloomberg California helped create the US solar industry, subsidizing rooftop panels at a time when the federal fight against climate change had barely begun. Now, it’s leading a sharp sales slowdown that’s threatening widespread adoption. Installers are slashing jobs. Bankruptcies are mounting. And it’s not just mom & pops feeling the pinch. The devastating collapse of FTX last year swept up one of the crypto industry’s hottest blockchains: Solana. Hailed for its high speeds and cheap transaction fees, the blockchain previously championed by (now-convicted felon) Sam Bankman-Fried saw the price of its SOL token plummet in the wake of FTX’s implosion. But now, many digital asset investors have pegged Solana as crypto’s comeback kid. With younger generations facing tough economic circumstances, many parents are supporting their children long past the college years. Nearly half of young adults in the US live at home, and millions more are receiving help with rent, bills and everyday costs. For parents, it's a major expense, sometimes requiring greater debt loads, depleted savings and delayed retirement plans. With greater student debt levels and a lack of affordable housing, the percentage of young adults living with their parents is roughly on par with the 1940s. There are two big reasons why.  Photographer: Maskot/Getty Images Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. |