These Two Indicators Say Bonds Are a Better Buy Than Stocks Right Now VIEW IN BROWSER

By MIKE BURNICK, CONTRIBUTING EDITOR, Market Minute Many folks think of bonds as being on the opposite end of the investment spectrum from stocks. In reality, they are often mixed in the same “balanced” investment portfolio. The theory is that when stocks zig to the downside, bonds should zag to the upside. Of course, it doesn’t always work out that way. Still, stocks and bonds do have a symbiotic relationship. And right now, according to two different measures, stocks are overvalued compared to bonds. First, let’s look at the earnings yield for stocks compared to bond yields. The value of stocks is determined in part by the interest rate offered on Treasury bonds. According to Warren Buffett: “The value of any stock … is determined by the cash inflows and outflows discounted at an appropriate interest rate.” And the discount rate used to determine a stock’s value is typically the interest rate on risk-free Treasury bonds.

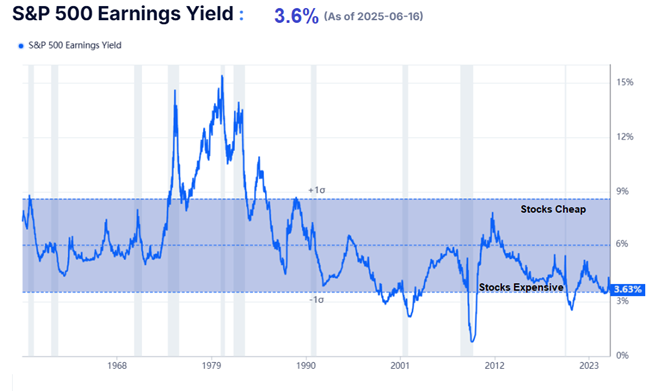

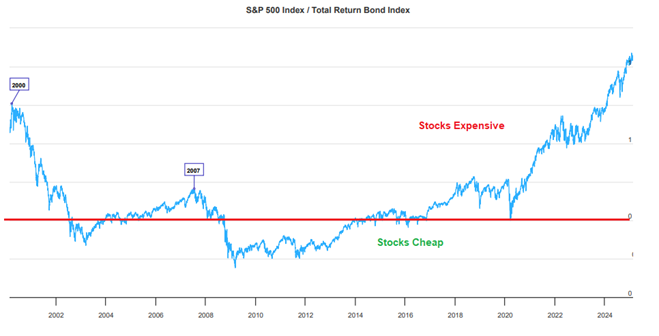

So, when bond yields are high relative to the earnings yield (or dividend yield) for stocks, bonds are considered the more attractive investment. Right now, you can earn a 3.6% earnings yield from the S&P 500 Index, as you can see above. Or you can earn 4.4% from a 10-year US Treasury bond. So, bonds are more attractive by this measure. Another way investors compare these two assets is the stock-to-bond ratio. This is simply the S&P 500 index divided by the US Corporate Total Return Bond Index. When the ratio rises, stocks beat bonds. And when it falls, bonds beat stocks. And when the ratio reaches an extreme high, as it is now, it can mean stocks are seriously overvalued compared to bonds. After such extremes, the trend often reverses, with stocks underperforming for a while.

Currently both measures of stock vs. bond valuation are saying the same thing: Stocks are expensive compared to bonds. And historically, that has not been good news for stocks, according to analysts at SentimenTrader. | Recommended Link | | | | There’s a Steve Jobs story that’s never been told. A secretive project he worked on in his final years that never saw the light of day. A vision so huge, so revolutionary, that it wasn’t just about the next hit product. But a plan to transform America itself. Details of its progress could become public as early as July 21st, and it could trigger an economic revolution that reshapes America’s future. Incredibly, Apple is NOT the buy. But this could be the most lucrative investment you ever make. |  |

Since 1969 in fact, when both of these stock vs. bond valuation measures reached extremes, the S&P 500 struggled with gains only 59% of the time over the next six months. That’s barely better than coin-flip odds. The maximum average loss for the S&P 500 was -8.5% compared to maximum average gains of just 7.4%. And the last two times this happened in 2002 and 2024, stocks dropped 21% and 29.2% over the next year. Mike Burnick’s Bottom Line: Stocks have rebounded in a big way since the April lows. But the stock market overall is trading at an extreme valuation again relative to bonds and by other measures. The historical data says stocks perform poorly after such extremes with larger than normal drawdown risk. Good investing,

Mike Burnick

Contributing Editor, Market Minute |