My wife and I recently welcomed our second child, Celeste, to the world. Mom and baby are happy and healthy. And we’re trying to get a little sleep when we can.

I was able to get some work done during our few days in the hospital. And I had a quick thought I want to share in today’s Smart Money Monday, including a “hospital stock” to avoid.

See, hospital rooms are full of public companies. The bassinet that cradled my daughter is owned by Stryker Corp. (SYK), an incredible medical device company.

The nurses’ walkie-talkies are made by a company called Vocera Communications, which Stryker bought in 2022 for $3 billion.

The nurses’ scrubs come from Figs Inc. (FIGS).

The internet routers and networking equipment are provided by Cisco Systems Inc. (CSCO).

And the hospital bed where my wife delivered our daughter is made by Hill-Rom Holdings.

A Monopoly on Hospital Beds

Hill-Rom was incorporated in 1969, and over the years—organically and through acquisitions—it came to practically control the hospital bed market.

According to a lawsuit filed in early 2022 by a competitor, Hill-Rom controls over 70% of the hospital bed market.

For competitors in the hospital bed industry, that’s certainly not a good thing. But for investors? That’s the sign of a good business—and possibly a lucrative investment.

Unfortunately, we can’t buy Hill-Rom today. It was acquired in 2022 by another healthcare company, Baxter International Inc. (BAX), for over $10 billion.

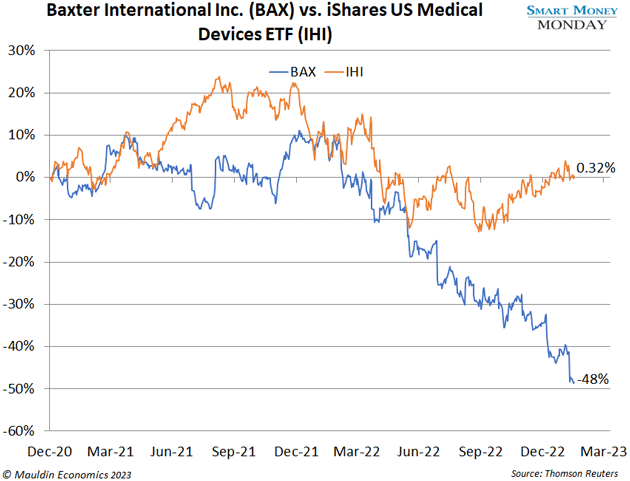

As you can see Baxter’s been whacked:

It’s down nearly 50% over the past three years and has underperformed the broader healthcare industry, as represented by the iShares US Medical Devices ETF (IHI).

Let’s dig deeper.

Low Rates and High Debt

Like Hill-Rom, Baxter is an old company (it was founded in 1931) and has grown through acquisitions.

To fund those deals, especially the Hill-Rom deal, the company borrowed a ton of money. And why not? Interest rates were incredibly low just one year ago. Back then, buying businesses with debt made a ton of sense. Wall Street and investors cheered it on. When money is practically free, buying companies with debt (at the time) seemed like a great use of capital.

Today, however, investors have changed their tune. Highly levered companies are not valued like they once were.

Baxter has $16 billion in debt. And about 25% of it is floating—meaning as rates go higher, so do its cash interest costs.

The company has seen its debt swell 160% since acquiring Hill-Rom. And yet, its EBITDA has grown just 28% over that same period.

The company is embarking on a strategy shift to try to solve this. That plan involves selling one division and spinning off another. That may work, but for now, it has a debt problem on its hands.

Baxter Is Ultimately a Risk I Don’t Want to Take

Baxter’s stock currently trades at around 10 times 2023 estimated EBITDA. That’s a steep discount to Stryker, which trades at 20 times EBITDA. There’s a good reason for the discount. It comes back to the debt.

Baxter is a highly levered company. Its leverage ratio—defined as net debt/EBITDA—is a steep 4.7 times. Stryker, on the other hand, is only levered two times.

While I do like the business of Baxter, and especially Hill-Rom, the stock is a pass for me… for now.

A highly levered balance sheet is a risk I don’t want to take. Layer on a hefty exposure to high interest rates through its floating debt, and Baxter is in a tough spot.

The situation may change when it executes its spinoff in the next 12 to 18 months. It will likely extract cash from the spinoff and use it to pay down debt at the parent company. That will help.

But until that happens, it remains a pass. But it’s one we’ll keep on our watchlist.

However, there is one “hospital stock” I do recommend today. Readers of my High Conviction Investor advisory know about it. It’s my latest pick and one of the best new ideas I’ve found this year.

On top of that, it’s extremely cheap and has a clear path to growing free cash flow and profit margins over the next few years.

You can access this pick with a subscription to High Conviction Investor. Go here for more details.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

P.S. A couple weeks ago, I told you about 40-year market veteran Keith Fitz-Gerald’s daily e-letter, Morning! 5 with Fitz. I’ve been enjoying Keith’s quick insights—he cuts straight to the chase and helps streamline the day-to-day happenings of the market.

Keith just sat down with Mauldin Economics Publisher Ed D’Agostino for an in-depth conversation covering today’s markets, Keith’s investing framework, Fed policy, and more. One part that caught my attention was his reasoning why, among 600,000+ tradable securities worldwide, only 50 truly matter for most portfolios.

It’s an insightful and entertaining interview. If you haven’t had the chance to watch it, you can find it here.

Suggested Reading...