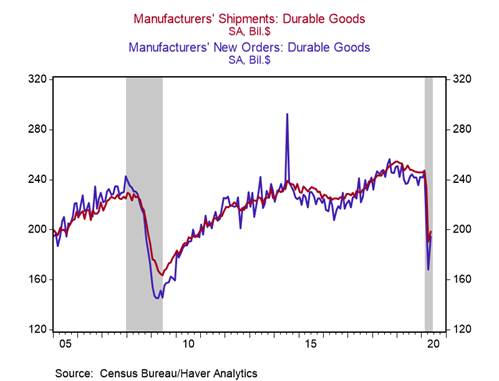

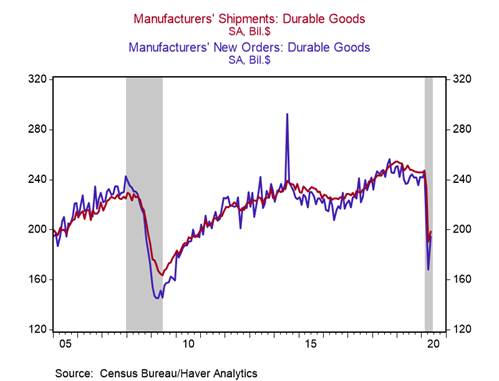

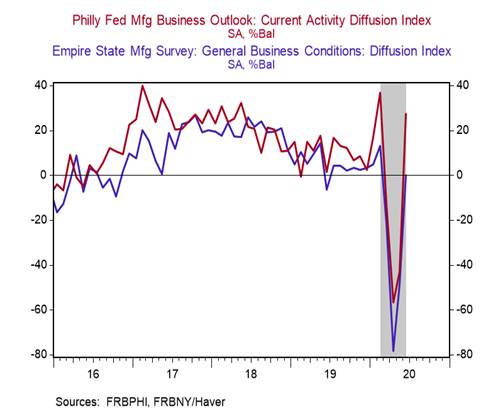

*U.S. durable goods orders (+15.8% m/m) and shipments (+4.4% m/m) both increased in May, but remained well below Februaryâs levels (orders: -21%, shipments: -19.7%), indicating the start of a long recovery for the manufacturing sector (Chart 1). May was a transition month for factories that were allowed to resume operations -- the improvement in regional manufacturing sentiment indexes point to a stronger rebound in durable goods shipments in June.

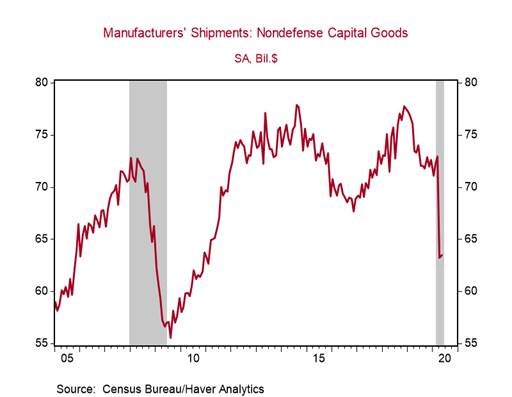

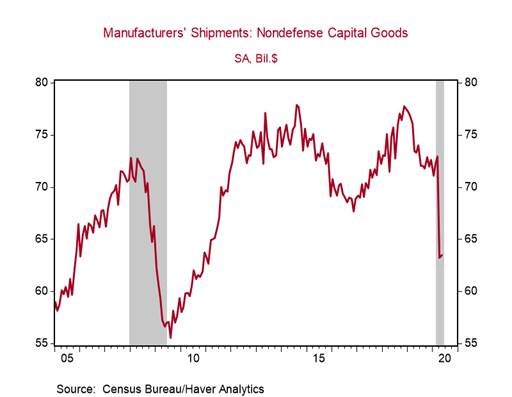

*Shipments of nondefense capital goods ‑- a proxy for business equipment investment in GDP ‑- barely increased in May (+0.4%), after a massive 13.3% m/m decline in April, and are on track to fall by 49% q/q annualized in Q2 (Chart 2).

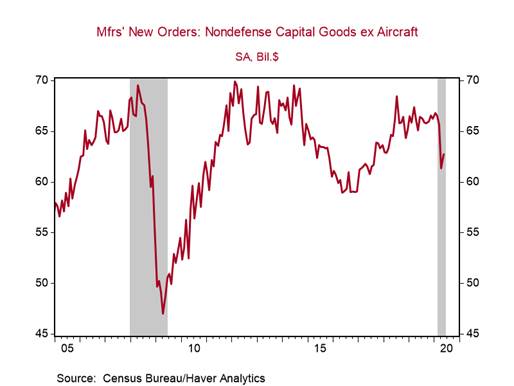

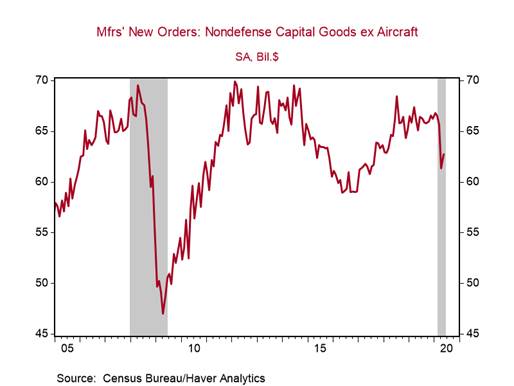

*Headline durable goods orders were boosted by the 80.7% m/m increase in transportation orders that had declined by a cumulative 70.8% in March and April. Orders of nondefense capital goods excluding aircraft, a reliable gauge of underlying manufacturing demand, increased by 2.3% m/m, remaining 5.6% below Februaryâs level (Chart 3).

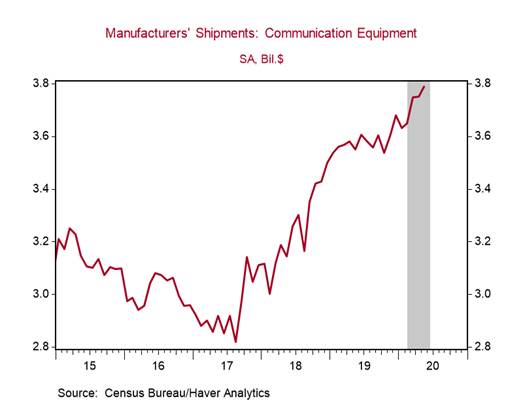

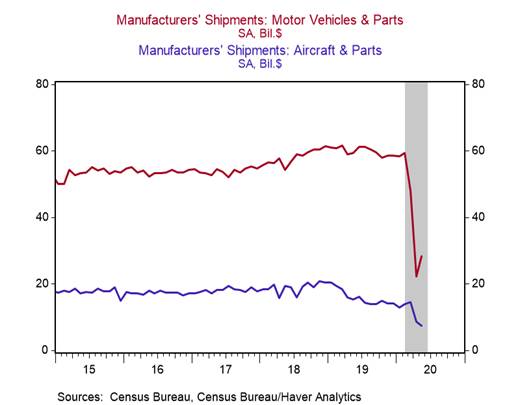

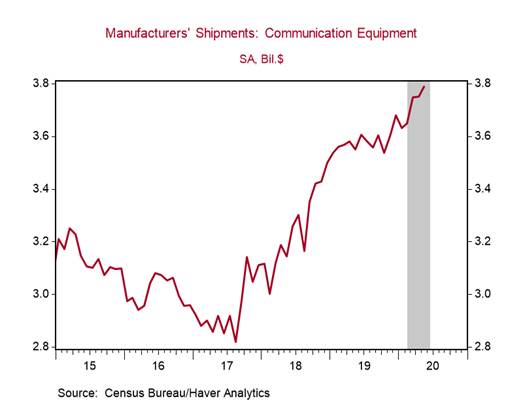

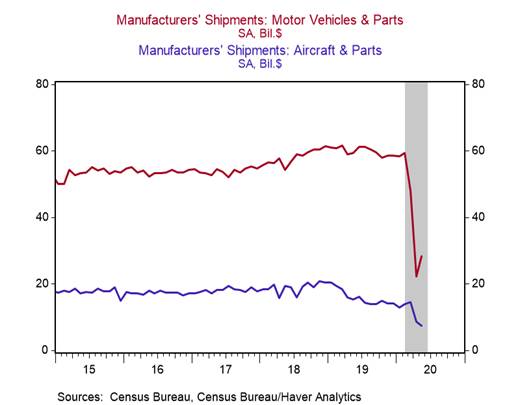

Eight of the nine primary categories of durable goods shipments increased in May, with shipments of aircraft and parts the lone exception (-13.1% m/m). Since February, shipments of communications equipment (+3.8%) and computers and related products (1.7%) have actually increased, far-outperforming other categories and consistent with broader economic trends during the COVID-19 pandemic (Chart 4). Shipments of motor vehicles and parts (-52.3%) and aircraft and parts (-46.7%) remain furthest below the February levels (Chart 5).

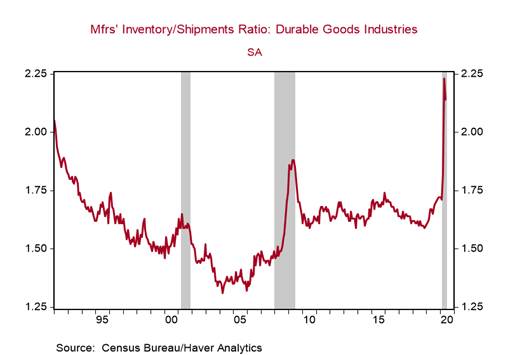

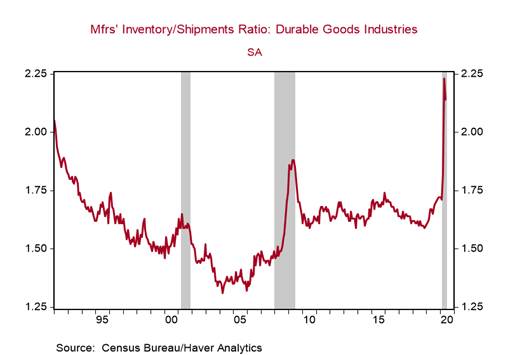

Durable goods inventories increased by a slight 0.1% m/m, leaving the inventory-shipments ratio at an elevated 2.14, the second highest on record (Chart 6). The ratio should fall further in June as shipments rebound at a faster pace.

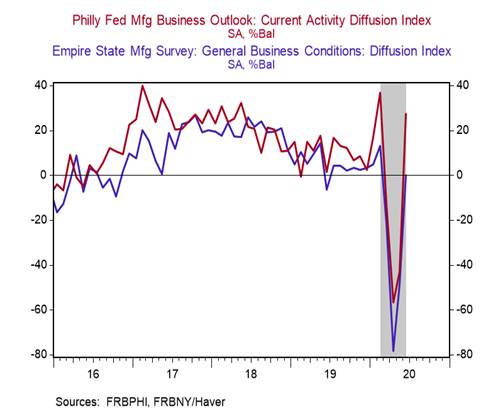

Manufacturing sentiment measures point to a stronger rebound in factory activity in June: 1) The Philly Fed manufacturing sentiment and Empire State manufacturing sentiment indexes surged by 70.6pts and 48.3pts, respectively, to 27.5 and -0.2 in June (Chart 7); and 2) and the Markit U.S. manufacturing PMI increased by 9.8pts to 49.6, just missing expansion territory (>50). After the initial rebound in manufacturing activity, we expect the recovery to be slow as disruptions to global supply chains will continue to affect production processes, businesses face sluggish global demand, and many are reluctant to increase investment amidst elevated uncertainties.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Chart 6:

Chart 7:

Roiana Reid, roiana.reid@berenberg-us.com

Member FINRA & SIPC

This email and any files or attachments transmitted with it may contain confidential or privileged information and are intended solely for the use of the intended recipient. If you are not the intended recipient, please do not copy, retain, disclose or use any part of the message or its attachments. Please notify the sender immediately by return email and destroy or delete any copies. Dissemination or use of this information by anyone other than the intended recipient is unauthorized and may be illegal. Communications by email cannot be guaranteed to be secure or error-free. Emails and their attachments are subject to being intercepted, becoming corrupted, getting lost or delayed, or may contain viruses. Therefore, neither the sender nor Berenberg Capital Markets LLC (BCM) accepts any liability for any errors or omissions in the content of this message or problems in its transmission, including those arising as a result of its transmission over the internet.

BCM does not assume liability for the correctness and completeness of all information given and/or attachments contained herein. The provided information has not been checked by a third party, especially an independent auditing firm. BCM explicitly points to the stated date of preparation. The information given can become incorrect due to passage of time and/or as a result of legal, political, economic or other changes. BCM does not assume responsibility to indicate such changes and/or to publish an updated document. Any document(s) or attachment(s) is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers.

In light of upcoming regulatory changes, please be informed that BCM will continue to share information with you until unsubscribe@berenberg-us.com receives your termination/deletion request. For more information about the General Data Protection Regulation (GDPR) and our privacy policies please refer to

https://www.berenberg-us.com/legal-notice/. BCM reserves all the rights in this communication. No part of this communication or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without BCMâs prior written consent.

For Berenberg the protection of your data has always been a top priority.

Any e-mail message (including any attachment) sent by Berenberg, any of its subsidiaries or any of their employees is strictly confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received such message(s) by mistake please notify the sender by return e-mail. We ask you to delete that message (including any attachments) thereafter from your system. Any unauthorised use or dissemination of that message in whole or in part (including any attachment) is strictly prohibited. Please also note that any legally binding representation needs to be signed by two authorised signatories. Therefore we do not send legally binding representations via e-mail. Furthermore we do not accept any legally binding representation and/or instruction(s) via e-mail.

In the event of any technical difficulty with any e-mails received from us, please contact the sender or info@berenberg.com. Please find more information on our Privacy Policy here.