Broad price pressures will curtail interest rate cuts: Although the rise in UK CPI inflation from 2.3% yoy in October to 2.6% in November (Bloomberg consensus: 2.6%) was largely driven by the more erratic components of inflation, rising labour costs limit the scope for further declines in underlying services inflation. It never seemed likely that the Bank of England would reduce its bank rate tomorrow after the strong pay growth data released yesterday. Instead, the question is now how many cuts can the BoE deliver next year? The upside surprise in the wage data has caused money markets to price in our forecast of two 25bp rate cuts, whereas the consensus among economic forecasters is currently four such moves.

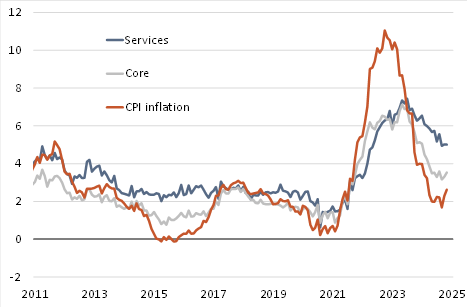

More normal goods inflation reveals upward march in services prices: The upward surprise in inflation compared to the BoEâs November forecast has not been driven by the parts of inflation policymakers are most worried about. Headline inflation of 2.6% in November exceeded the 2.4% the BoE forecast due to food price inflation coming in 0.9ppt above the central bankâs forecast, and core goods inflation 0.3ppts higher. Services inflation, unchanged at 5.0% yoy in November, was only 0.1ppt stronger than the central bankâs prediction. Core goods and food inflation have been unusually low over the past year due to falling energy and global food prices â see Chart 1. As that drag continues to fade, elevated services inflation will become more apparent. We expect CPI inflation to rise to an average of 3.0% over the second half of 2025.

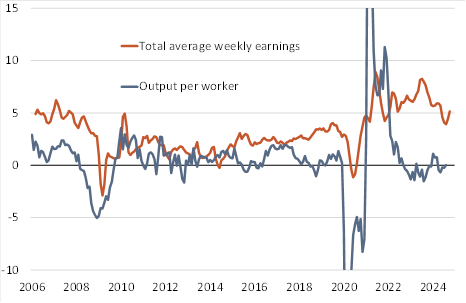

High pay growth and stagnant productivity are inflationary. What gives? Pay growth of over 5% yoy while output per worker stagnates means that unit labour costs are rising quickly â see Chart 2. The increase in tax on employers will increase costs further from April. That cost pressure will be most acute for services firms, for which staff make up most of their costs. This raises the question how much services inflation can decline. Historically a 3% yoy increase in services prices has been consistent with the inflation target, which currently feels a long way off. Achieving that likely requires productivity to increase, pay growth to slow, or a combination of the two. Therefore, we think that the BoE will not be able to justify more than two rate cuts next year, particularly if we are right to think that the recent weakness in GDP growth will be temporary.

Chart 1: Domestically-generated inflation is still above target |

|

In % yoy. Inflation in the CPI and selected sub-indicies. Source: Haver. |

Chart 2: What gives? Pay growth is well above productivity growth |

|

In % yoy. Sources: Haver, Berenberg |

Andrew Wishart

+44 20 3753 3017

Berenberg

60 Threadneedle Street

London EC2R 8HP

United Kingdom

For Berenberg the protection of your data has always been a top priority. Please find information on the processing of personal data here.

Any e-mail message (including any attachment) sent by Berenberg, any of its subsidiaries or any of their employees is strictly confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received such message(s) by mistake please notify the sender by return e-mail. We ask you to delete that message (including any attachments) thereafter from your system. Any unauthorised use or dissemination of that message in whole or in part (including any attachment) is strictly prohibited. Please also note that any legally binding representation needs to be signed by two authorised signatories. Therefore we do not send legally binding representations via e-mail. Furthermore we do not accept any legally binding representation and/or instruction(s) via e-mail. In the event of any technical difficulty with any e-mails received from us, please contact the sender or info@berenberg.com. Deutscher disclaimer.

Click here to unsubscribe from these emails.