Two of our Smart Money Monday (SMM) ideas are inching closer toward deals.

While one remains uncertain, the other looks like a sure thing.

In short, I like the setups for both. And, by the way, these aren’t small tuck-in deals. These are mega deals that have the potential to create two global giants.

A Steel Giant

Long-time SMM favorite Cleveland-Cliffs Inc. (CLF), the former iron ore miner turned vertically integrated steel company, is in active pursuit of competitor United States Steel Corp. (X).

In August, Cleveland-Cliffs announced a half stock/half cash offer for 100% of US Steel.

It’s been eerily quiet since then. My sense is that US Steel doesn’t have any other legitimate suitors. So, it should, without question, take Cleveland-Cliffs’ offer for several reasons.

A combined Cliffs and US Steel would create the 10th-largest steel company in the world based on metric tons of steel production.

The plan calls for $500 million in synergies. And given that the deal includes stock, US Steel shareholders will get to participate in all this upside. Compare that with a private equity offer that’s all cash. Shareholders get a nice pop, sure. But they don’t get to participate in the ongoing value creation.

After Cliffs went public with its offer, a smaller outfit allegedly submitted an all-cash proposal. The press release was odd, to say the least. After a week or so, it retracted its “bid.”

Two other names have popped up as potential suitors…

The first is multinational steel manufacturing corporation ArcelorMittal. Maybe it’s interested in getting back into the US market? After all, it sold its US steel business to Cleveland-Cliffs in 2021. Getting back in through this deal would be bizarre. Also, it would likely get blocked on national security grounds.

Then, we have Canadian-listed Stelco Holdings (STLC). This one intrigues me. I’ve followed Stelco for several years. My favorite insurance company, Fairfax Financial (FRFHF), owns over 20% of Stelco stock. CEO and Chairman Alan Kestenbaum is a serial deal maker and value creator.

The rumor now is that Stelco is looking at making a bid for US Steel. My guess is that Stelco will offer to buy some of the assets that US Steel is required to divest for a Cliffs/US Steel tie-up to occur. But, again, that’s speculation.

There’s a lot going on behind closed doors. As far as I can tell, though, a merger of Cleveland-Cliffs and US Steel makes the most sense for shareholders.

A Global Paper Giant

So, we have a global steel giant in the making. But we also have a global paper giant in the works.

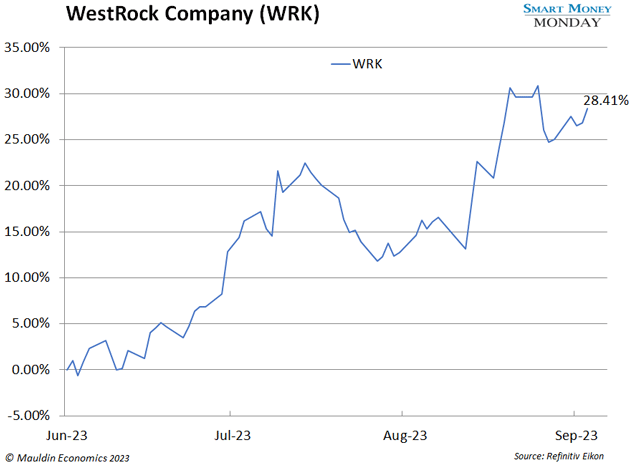

Earlier this year, I wrote how I was buying paper products company WestRock Co. (WRK). So far, so good—the stock is up nearly 30%.

Did you buy? I’d love to hear about it if so.

A few weeks back, Westrock shocked the packaging world with its announced merger of equals with Irish-based Smurfit Kappa.

Unlike the Cleveland-Cliffs/US Steel situation, Westrock and Smurfit Kappa have already agreed on a deal. The combined company will be a giant, with $34 billion in revenue. It will be the largest public paper company in the world by revenue.

I like the deal and how it’s set up. It’s a merger of equals, with both companies essentially combining at around the same multiple of EBITDA. Westrock shareholders will get $5 in cash and one new share of the combined company.

In addition, despite it being a “mega merger,” I still believe it can get regulatory approval. Smurfit has very little North American presence, so the deal shouldn’t present any issues with US regulators. And Westrock has very little European presence, so the European regulators also have no reason to block it.

The combined company will be run by Tony Smurfit. Tony’s grandfather, Jefferson Smurfit, founded the company in the 1930s. Tony’s name is—and will remain—on the door. So he’s aligned with shareholders and wants to continue his family legacy.

Looking at the numbers, there are a good number of synergies earmarked post-closing of the deal, so shareholders of the new company, Smurfit Westrock, should do well.

I continue to like and own the stock. The deal should close sometime in Q2 2024.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Suggested Reading...